Question: Question 1 Consider the Capital Asset Pricing Model (CAPM hereafter): a). Explain the main conclusions of the CAPM. Describe the equation of the Security Market

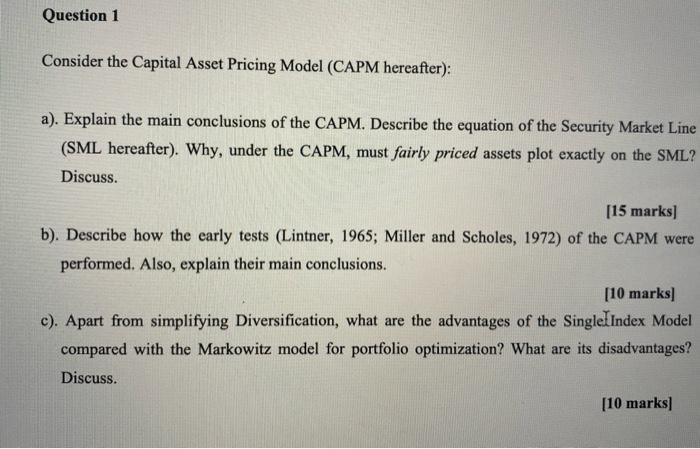

Question 1 Consider the Capital Asset Pricing Model (CAPM hereafter): a). Explain the main conclusions of the CAPM. Describe the equation of the Security Market Line (SML hereafter). Why, under the CAPM, must fairly priced assets plot exactly on the SML? Discuss. [15 marks] b). Describe how the early tests (Lintner, 1965; Miller and Scholes, 1972) of the CAPM were performed. Also, explain their main conclusions. [10 marks] c). Apart from simplifying Diversification, what are the advantages of the SinglelIndex Model compared with the Markowitz model for portfolio optimization? What are its disadvantages? Discuss. [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts