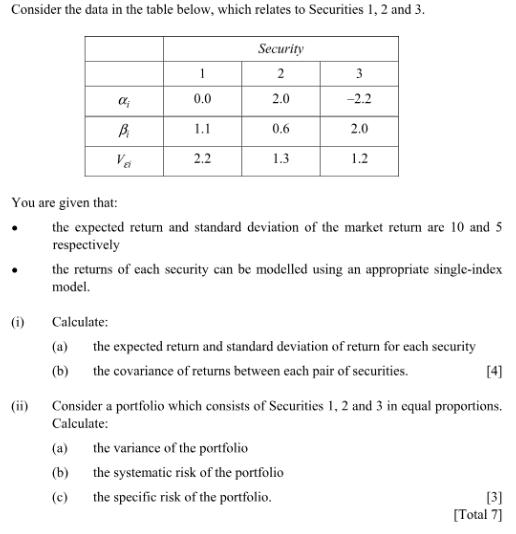

Question: Consider the data in the table below, which relates to Securities 1, 2 and 3. (i) ; B 1 0.0 1.1 2.2 Security 2

Consider the data in the table below, which relates to Securities 1, 2 and 3. (i) ; B 1 0.0 1.1 2.2 Security 2 2.0 0.6 (a) (b) (c) 1.3 You are given that: the expected return and standard deviation of the market return are 10 and 5 respectively 3 -2.2 2.0 1.2 the returns of each security can be modelled using an appropriate single-index model. Calculate: (a) the expected return and standard deviation of return for each security (b) the covariance of returns between each pair of securities. the variance of the portfolio the systematic risk of the portfolio the specific risk of the portfolio. Consider a portfolio which consists of Securities 1, 2 and 3 in equal proportions. Calculate: [4] [3] [Total 7]

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

To calculate the expected return and standard deviation of return for each security you can use the singleindex model which relates the securitys retu... View full answer

Get step-by-step solutions from verified subject matter experts