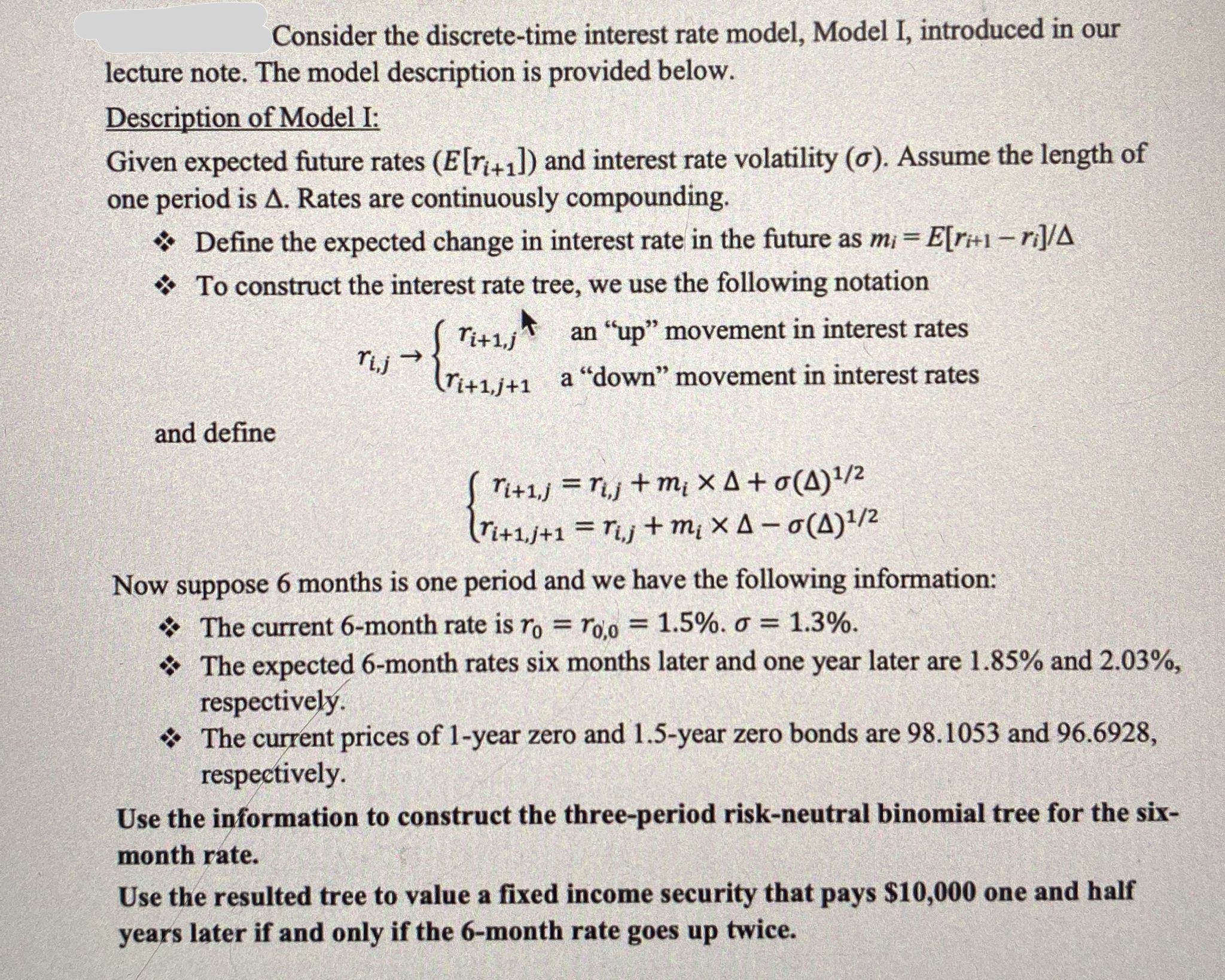

Question: Consider the discrete-time interest rate model, Model I, introduced in our lecture note. The model description is provided below. Description of Model I: Given expected

Step by Step Solution

There are 3 Steps involved in it

Lets carefully work through this problem step by step We are given Model Setup Time step Delta 05 years 6 months per period Current rate r0 T00 15 Volatility sigma 13 Expected future 6month rates 6 mo... View full answer

Get step-by-step solutions from verified subject matter experts