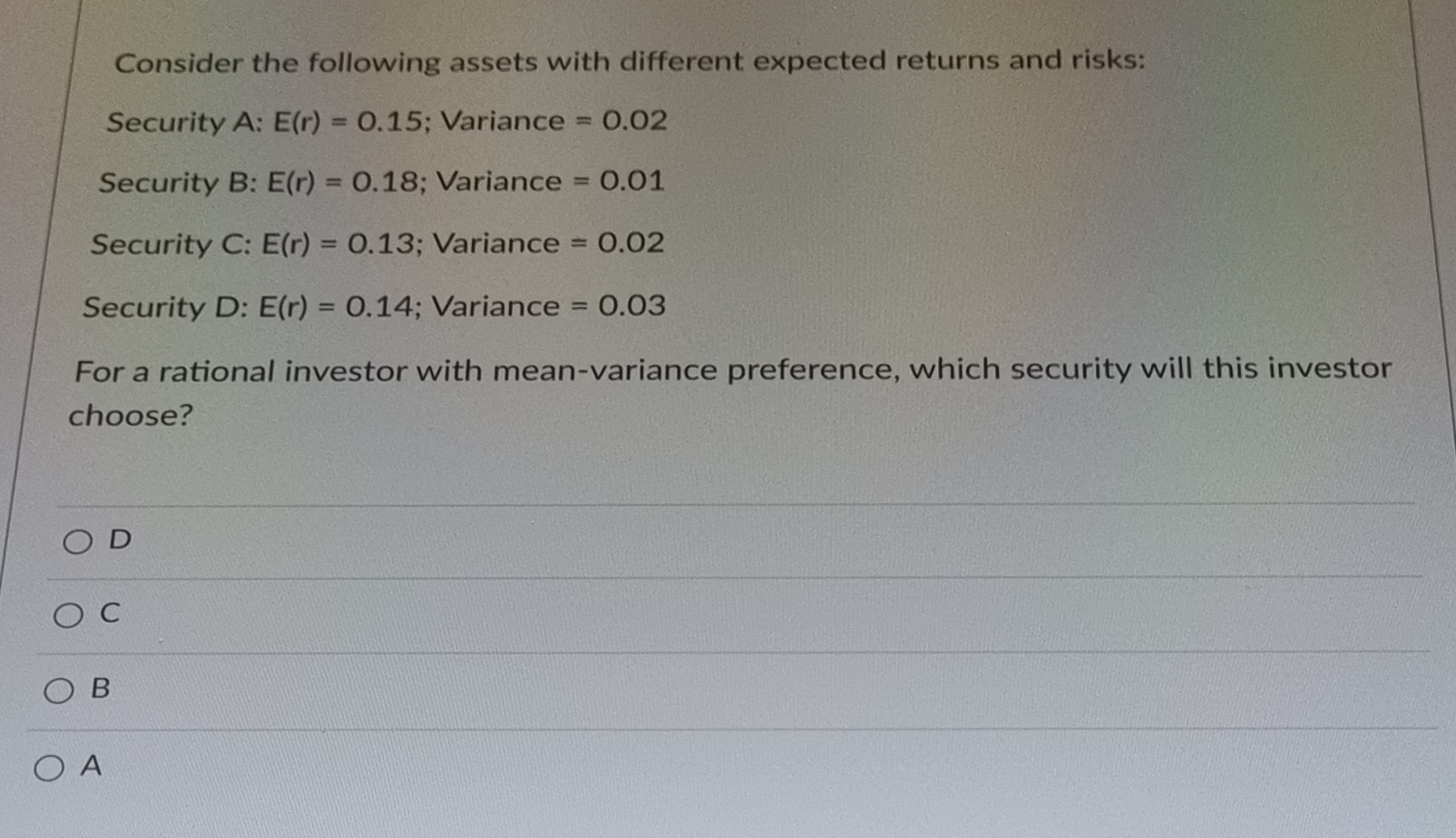

Question: Consider the following assets with different expected returns and risks: Security A: E(r) = 0.15; Variance = 0.02 Security B: E(r) = 0.18; Variance =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts