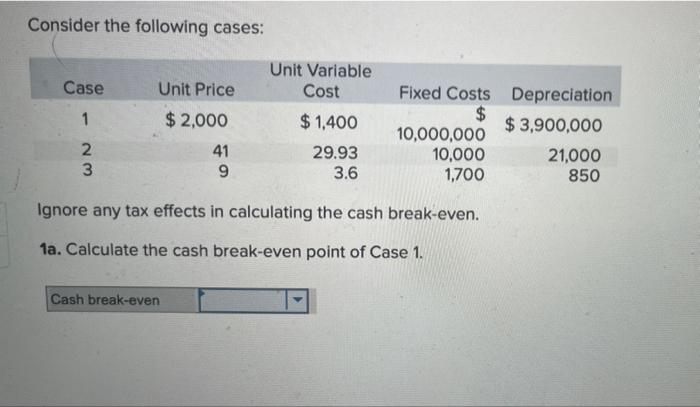

Question: Consider the following cases: Case Unit Variable Cost Unit Price $ 2,000 1 $ 1,400 29.93 Fixed Costs Depreciation $ $3,900,000 10,000,000 10,000 21,000 1,700

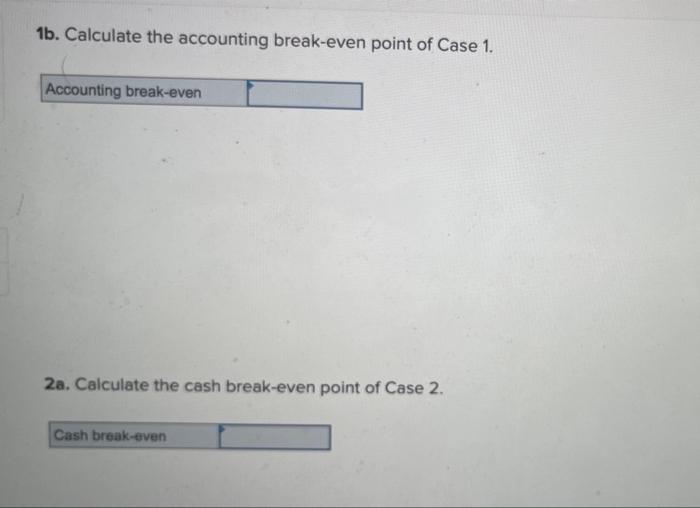

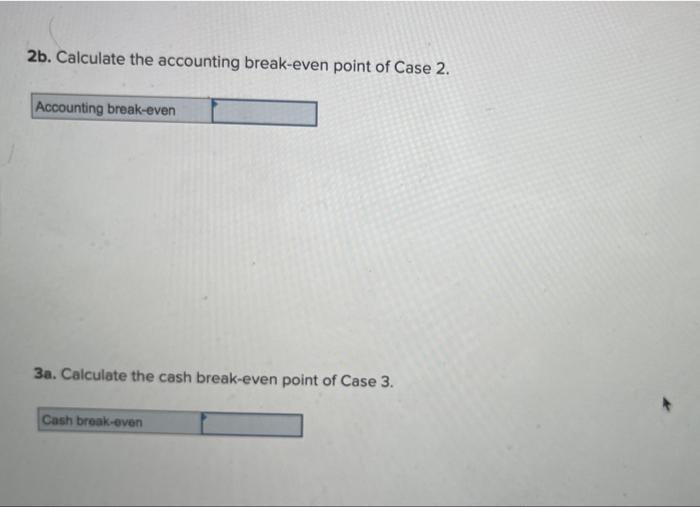

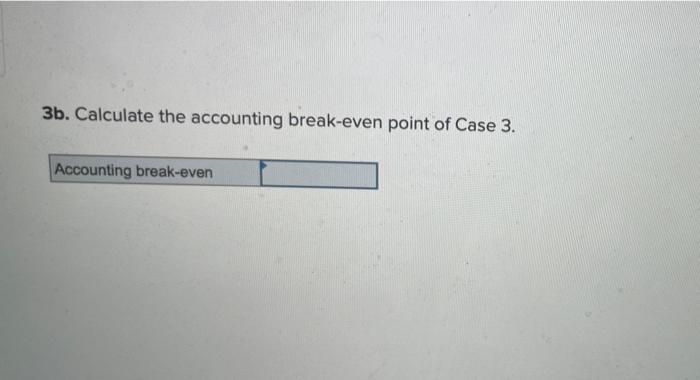

Consider the following cases: Case Unit Variable Cost Unit Price $ 2,000 1 $ 1,400 29.93 Fixed Costs Depreciation $ $3,900,000 10,000,000 10,000 21,000 1,700 850 2 3 41 9 3.6 Ignore any tax effects in calculating the cash break-even. 1a. Calculate the cash break-even point of Case 1. Cash break-even 1b. Calculate the accounting break-even point of Case 1. Accounting break-even 2a. Calculate the cash break-even point of Case 2. Cash break-even 2b. Calculate the accounting break-even point of Case 2. Accounting break-even 3a. Calculate the cash break-even point of Case 3. Cash break-even 3b. Calculate the accounting break-even point of Case 3. Accounting break-even

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts