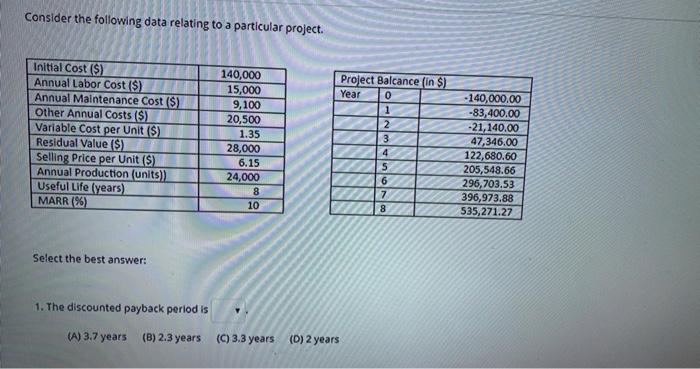

Question: Consider the following data relating to a particular project. Initial Cost ($) Annual Labor Cost (5) Annual Maintenance Cost (5) Other Annual Costs ($) Variable

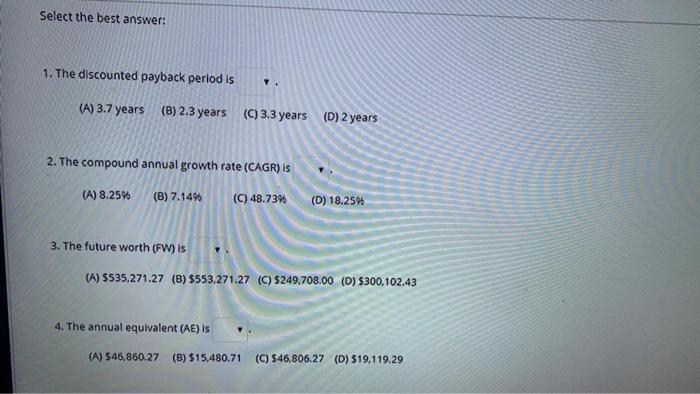

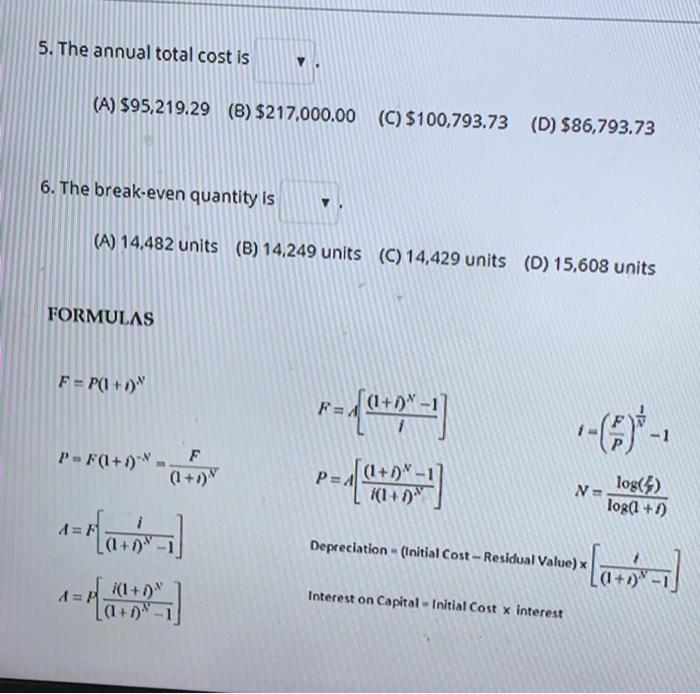

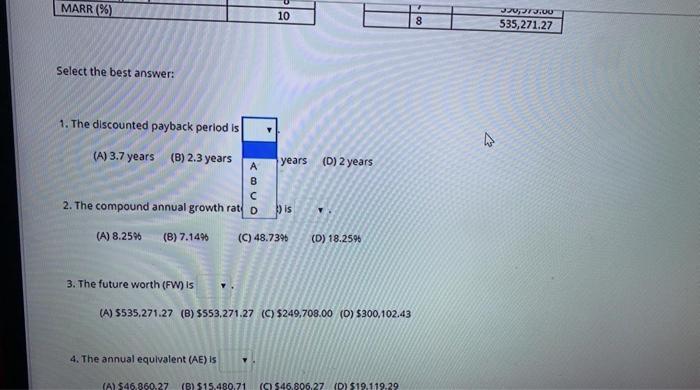

Consider the following data relating to a particular project. Initial Cost ($) Annual Labor Cost (5) Annual Maintenance Cost (5) Other Annual Costs ($) Variable Cost per Unit ($) Residual Value ($) Selling Price per Unit ($) Annual Production (units) Useful Life (years) MARR (%) 140,000 15,000 9,100 20,500 1.35 28,000 6.15 24,000 8 10 Project Balcance (in $) Year 0 1 2 3 -140,000.00 -83,400.00 -21,140.00 47,346.00 122,680.60 205,548.66 296, 703.53 396,973.88 535,271.27 IS 8 Select the best answer: 1. The discounted payback period is (A) 3.7 years (B) 2.3 years (C) 3.3 years (0) 2 years Select the best answer: 1. The discounted payback period is (A) 3.7 years (8) 2.3 years (C) 3.3 years (D) 2 years 2. The compound annual growth rate (CAGR) is (A) 8.25% (8) 7.1496 (C) 48.739 (D) 18.2596 3. The future worth (FW) is (A) 5535.271.27 (8) $553.271.27 (C) $249.708.00 (D) $300.102.43 4. The annual equivalent (AE) is (A) $46,860.27 (8) $15,480.71 (C) $46,806,27 (D) $19,119.29 5. The annual total cost is (A) $95,219.29 (8) $217,000.00 (C) $100,793.73 (D) $86,793.73 6. The break-even quantity is (A) 14,482 units (B) 14,249 units (C) 14,429 units (D) 15,608 units FORMULAS F = P(1+0) F=4 P=F(+ 0F P=1 ( (1 + 1) (1+1) N- log(4) log(1+1) 1=F Depreciation - (Initial Cost - Residual Value) 1 (1+1). (I+D Interest on Capital - Initial Cost x interest MARR (%) 10 8 JUIS.00 535,271.27 Select the best answer: 1. The discounted payback period is years (D) 2 years (A) 3.7 years (8) 2.3 years A B 2. The compound annual growth rat D is V (A) 8.25% (8) 7.14% (C) 48.7396 (D) 18.2596 3. The future worth (FW) is (A) $535.271.27 (8) $553,271.27 ()$249,708.00 (0) $300,102.43 4. The annual equivalent (AE) is (A) 546.860.27 (B) $15.480.71 (C) $46,806,27 (D) $19.119.29 Consider the following data relating to a particular project. Initial Cost ($) Annual Labor Cost (5) Annual Maintenance Cost (5) Other Annual Costs ($) Variable Cost per Unit ($) Residual Value ($) Selling Price per Unit ($) Annual Production (units) Useful Life (years) MARR (%) 140,000 15,000 9,100 20,500 1.35 28,000 6.15 24,000 8 10 Project Balcance (in $) Year 0 1 2 3 -140,000.00 -83,400.00 -21,140.00 47,346.00 122,680.60 205,548.66 296, 703.53 396,973.88 535,271.27 IS 8 Select the best answer: 1. The discounted payback period is (A) 3.7 years (B) 2.3 years (C) 3.3 years (0) 2 years Select the best answer: 1. The discounted payback period is (A) 3.7 years (8) 2.3 years (C) 3.3 years (D) 2 years 2. The compound annual growth rate (CAGR) is (A) 8.25% (8) 7.1496 (C) 48.739 (D) 18.2596 3. The future worth (FW) is (A) 5535.271.27 (8) $553.271.27 (C) $249.708.00 (D) $300.102.43 4. The annual equivalent (AE) is (A) $46,860.27 (8) $15,480.71 (C) $46,806,27 (D) $19,119.29 5. The annual total cost is (A) $95,219.29 (8) $217,000.00 (C) $100,793.73 (D) $86,793.73 6. The break-even quantity is (A) 14,482 units (B) 14,249 units (C) 14,429 units (D) 15,608 units FORMULAS F = P(1+0) F=4 P=F(+ 0F P=1 ( (1 + 1) (1+1) N- log(4) log(1+1) 1=F Depreciation - (Initial Cost - Residual Value) 1 (1+1). (I+D Interest on Capital - Initial Cost x interest MARR (%) 10 8 JUIS.00 535,271.27 Select the best answer: 1. The discounted payback period is years (D) 2 years (A) 3.7 years (8) 2.3 years A B 2. The compound annual growth rat D is V (A) 8.25% (8) 7.14% (C) 48.7396 (D) 18.2596 3. The future worth (FW) is (A) $535.271.27 (8) $553,271.27 ()$249,708.00 (0) $300,102.43 4. The annual equivalent (AE) is (A) 546.860.27 (B) $15.480.71 (C) $46,806,27 (D) $19.119.29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts