Consider the following duopoly consisting of Firm 1 (The Incumbent) and Firm 2 (The Entrant) that...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

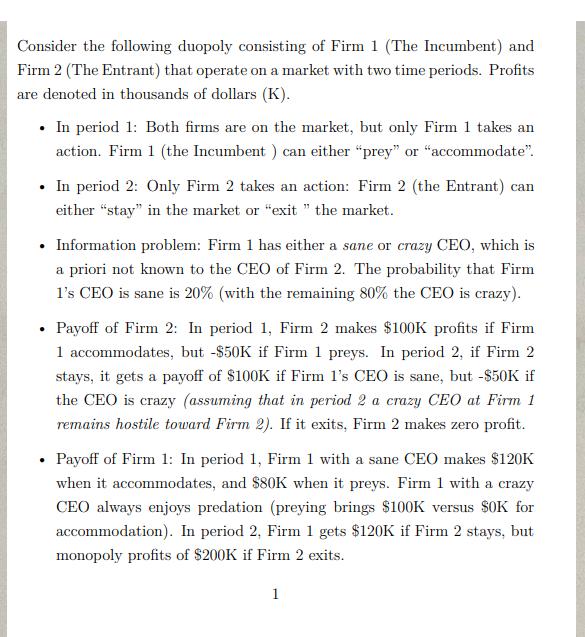

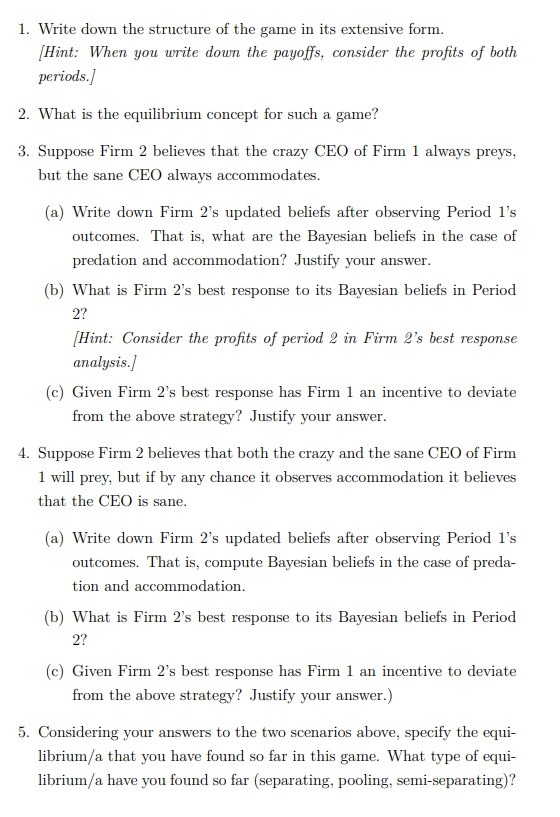

Consider the following duopoly consisting of Firm 1 (The Incumbent) and Firm 2 (The Entrant) that operate on a market with two time periods. Profits are denoted in thousands of dollars (K). . In period 1: Both firms are on the market, but only Firm 1 takes an action. Firm 1 (the Incumbent ) can either "prey" or "accommodate". In period 2: Only Firm 2 takes an action: Firm 2 (the Entrant) can either "stay" in the market or "exit "the market. Information problem: Firm 1 has either a sane or crazy CEO, which is a priori not known to the CEO of Firm 2. The probability that Firm 1's CEO is sane is 20% (with the remaining 80% the CEO is crazy). Payoff of Firm 2: In period 1, Firm 2 makes $100K profits if Firm 1 accommodates, but -$50K if Firm 1 preys. In period 2, if Firm 2 stays, it gets a payoff of $100K if Firm 1's CEO is sane, but -$50K if the CEO is crazy (assuming that in period 2 a crazy CEO at Firm 1 remains hostile toward Firm 2). If it exits, Firm 2 makes zero profit. Payoff of Firm 1: In period 1, Firm 1 with a sane CEO makes $120K when it accommodates, and $80K when it preys. Firm 1 with a crazy CEO always enjoys predation (preying brings $100K versus $0K for accommodation). In period 2, Firm 1 gets $120K if Firm 2 stays, but monopoly profits of $200K if Firm 2 exits. 1 1. Write down the structure of the game in its extensive form. [Hint: When you write down the payoffs, consider the profits of both periods.] 2. What is the equilibrium concept for such a game? 3. Suppose Firm 2 believes that the crazy CEO of Firm 1 always preys, but the sane CEO always accommodates. (a) Write down Firm 2's updated beliefs after observing Period 1's outcomes. That is, what are the Bayesian beliefs in the case of predation and accommodation? Justify your answer. (b) What is Firm 2's best response to its Bayesian beliefs in Period 2? [Hint: Consider the profits of period 2 in Firm 2's best response analysis.] (c) Given Firm 2's best response has Firm 1 an incentive to deviate from the above strategy? Justify your answer. 4. Suppose Firm 2 believes that both the crazy and the sane CEO of Firm 1 will prey, but if by any chance it observes accommodation it believes that the CEO is sane. (a) Write down Firm 2's updated beliefs after observing Period 1's outcomes. That is, compute Bayesian beliefs in the case of preda- tion and accommodation. (b) What is Firm 2's best response to its Bayesian beliefs in Period 2? (c) Given Firm 2's best response has Firm 1 an incentive to deviate from the above strategy? Justify your answer.) 5. Considering your answers to the two scenarios above, specify the equi- librium/a that you have found so far in this game. What type of equi- librium/a have you found so far (separating, pooling, semi-separating)? Hint: Remember, an equilibrium must specify the players' best responses and their beliefs in the equilibrium. 6. Does is it make sense for the sane CEO to mimic a crazy one? Consider the following duopoly consisting of Firm 1 (The Incumbent) and Firm 2 (The Entrant) that operate on a market with two time periods. Profits are denoted in thousands of dollars (K). . In period 1: Both firms are on the market, but only Firm 1 takes an action. Firm 1 (the Incumbent ) can either "prey" or "accommodate". In period 2: Only Firm 2 takes an action: Firm 2 (the Entrant) can either "stay" in the market or "exit "the market. Information problem: Firm 1 has either a sane or crazy CEO, which is a priori not known to the CEO of Firm 2. The probability that Firm 1's CEO is sane is 20% (with the remaining 80% the CEO is crazy). Payoff of Firm 2: In period 1, Firm 2 makes $100K profits if Firm 1 accommodates, but -$50K if Firm 1 preys. In period 2, if Firm 2 stays, it gets a payoff of $100K if Firm 1's CEO is sane, but -$50K if the CEO is crazy (assuming that in period 2 a crazy CEO at Firm 1 remains hostile toward Firm 2). If it exits, Firm 2 makes zero profit. Payoff of Firm 1: In period 1, Firm 1 with a sane CEO makes $120K when it accommodates, and $80K when it preys. Firm 1 with a crazy CEO always enjoys predation (preying brings $100K versus $0K for accommodation). In period 2, Firm 1 gets $120K if Firm 2 stays, but monopoly profits of $200K if Firm 2 exits. 1 1. Write down the structure of the game in its extensive form. [Hint: When you write down the payoffs, consider the profits of both periods.] 2. What is the equilibrium concept for such a game? 3. Suppose Firm 2 believes that the crazy CEO of Firm 1 always preys, but the sane CEO always accommodates. (a) Write down Firm 2's updated beliefs after observing Period 1's outcomes. That is, what are the Bayesian beliefs in the case of predation and accommodation? Justify your answer. (b) What is Firm 2's best response to its Bayesian beliefs in Period 2? [Hint: Consider the profits of period 2 in Firm 2's best response analysis.] (c) Given Firm 2's best response has Firm 1 an incentive to deviate from the above strategy? Justify your answer. 4. Suppose Firm 2 believes that both the crazy and the sane CEO of Firm 1 will prey, but if by any chance it observes accommodation it believes that the CEO is sane. (a) Write down Firm 2's updated beliefs after observing Period 1's outcomes. That is, compute Bayesian beliefs in the case of preda- tion and accommodation. (b) What is Firm 2's best response to its Bayesian beliefs in Period 2? (c) Given Firm 2's best response has Firm 1 an incentive to deviate from the above strategy? Justify your answer.) 5. Considering your answers to the two scenarios above, specify the equi- librium/a that you have found so far in this game. What type of equi- librium/a have you found so far (separating, pooling, semi-separating)? Hint: Remember, an equilibrium must specify the players' best responses and their beliefs in the equilibrium. 6. Does is it make sense for the sane CEO to mimic a crazy one?

Expert Answer:

Related Book For

An Introduction to the Mathematics of Financial Derivatives

ISBN: 978-0123846822

3rd edition

Authors: Ali Hirsa, Salih N. Neftci

Posted Date:

Students also viewed these economics questions

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Find a basis for the subspace Wspanned by {v1, v2 , V3, V4}. 2 Let vi = -3,v2 = 2 ,v3 -2,v4 = 3

-

The data in Figure 1-1(12-1) end in 2012. Visit oanda.com (or another site with daily exchange rate data) and download data on the same exchange rates (yuan per dollar and dollar per euro) for the...

-

What is the level of each vertex of the rooted tree in Exercise 3? I m n

-

In reporting on internal control, the GAO's Government Auditing Standards imposes more responsibility on an auditor than SAS No. 60, "Communication of Internal Control Structure Related Matters Noted...

-

Business Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor and direct materials per unit for the year are as follows: The standard price paid per...

-

Discuss the role of kernel-level synchronization primitives, such as spinlocks, semaphores, and mutexes, in ensuring safe concurrent access to shared resources. How does improper synchronization lead...

-

Use the following selected account balances of Delray Manufacturing for the year ended December 31. Sales $ 2,250,000 Raw materials inventory, beginning 94,000 Work in process inventory, beginning...

-

Assuming Jeff has a mild chronic disease, and he has a private hospital health insurance. His salary before tax is $170,000. And assuming he has sold $30,000 of mutual fund units after he bought them...

-

Describe the classic steps for identifying an endocrine gland. Are these steps practical for identifying the sources of all the hormones we know of today? Explain.

-

Your portfolio which consists of 46% of stock J, and 54% of stock K. J has daily Standard Deviation 3% while K has daily Standard Deviation 4%. The correlation of two stocks is -0.6. What is the 1...

-

Add as indicated. Write all answers in lowest terms. 3 - + 2 X X-7 3X 2 = X-7 (Simplify your answer.)

-

f(x)=5x+2 g(x)=3x-7 (f-g)(-2): (F) (2)

-

Read the case study Group-on: Finding Strength in Numbers: Group-ons business strategy harnesses what it calls collective buying power. What facets of the marketing environment have enabled a...

-

Fahrad Inc. sells all of its product on account. Fahrad has the following accounts receivable payment experience: Percent paid in the month of sale .........10 Percent paid in the month after the...

-

You have been assigned to audit the accounts payable of Slamtastic, a small recording company specializing in alternative music. Following is a portion of their accounts payable journal for the month...

-

Consider the data from the previous problem. For each of the sampling methods named: a. Compute the total amount of the transactions sampled and the proportion of the cumulative total the sample...

-

Suppose that an auditor chooses to use a random sampling technique to test additions to fixed assets for the fiscal year for manufacturing company. Walk through the key steps the auditor should...

Study smarter with the SolutionInn App