Question: Consider the following facts for Java Jolt: a. Beginning and ending Retained Earnings are $47,000 and $72,000, respectively. Net income for the period is $64,000.

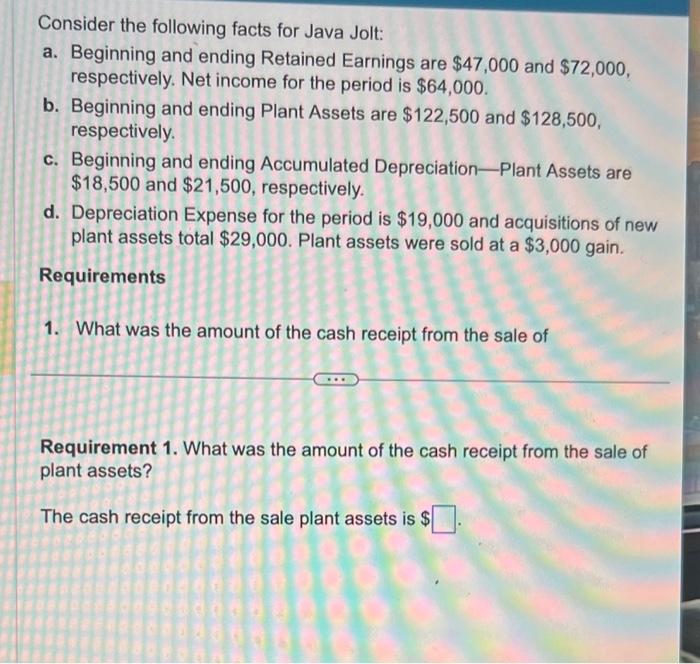

Consider the following facts for Java Jolt: a. Beginning and ending Retained Earnings are $47,000 and $72,000, respectively. Net income for the period is $64,000. b. Beginning and ending Plant Assets are $122,500 and $128,500, respectively. c. Beginning and ending Accumulated Depreciation-Plant Assets are $18,500 and $21,500, respectively. d. Depreciation Expense for the period is $19,000 and acquisitions of new plant assets total $29,000. Plant assets were sold at a $3,000 gain. Requirements 1. What was the amount of the cash receipt from the sale of Requirement 1. What was the amount of the cash receipt from the sale of plant assets? The cash receipt from the sale plant assets is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts