Question: Consider the following information and data given in the table below in this section and answer the following questions: Company A is into automobile manufacturing

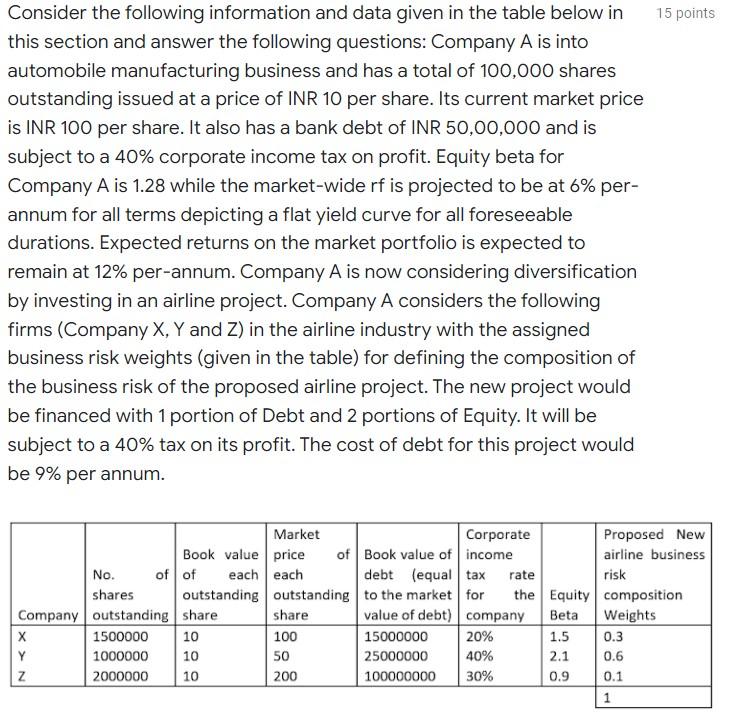

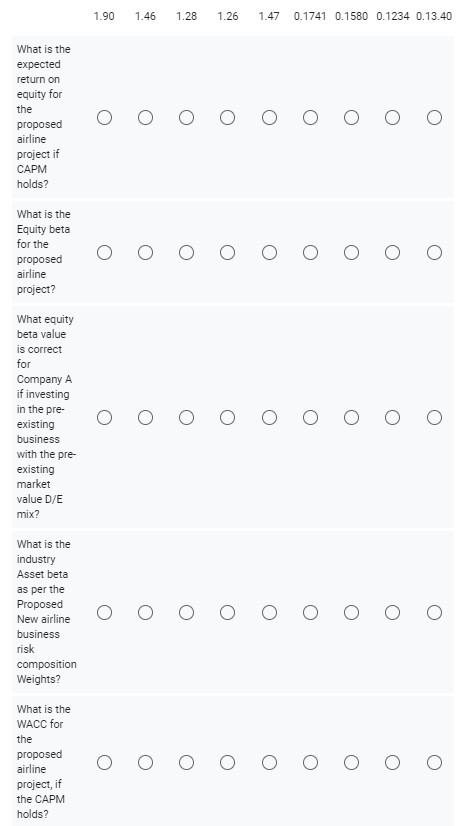

Consider the following information and data given in the table below in this section and answer the following questions: Company A is into automobile manufacturing business and has a total of 100,000 shares outstanding issued at a price of INR 10 per share. Its current market price is INR 100 per share. It also has a bank debt of INR 50,00,000 and is subject to a 40% corporate income tax on profit. Equity beta for Company A is 1.28 while the market-wide rf is projected to be at 6% per-annum for all terms depicting a flat yield curve for all foreseeable durations. Expected returns on the market portfolio is expected to remain at 12% per-annum. Company A is now considering diversification by investing in an airline project. Company A considers the following firms (Company X, Y and Z) in the airline industry with the assigned business risk weights (given in the table) for defining the composition of the business risk of the proposed airline project. The new project would be financed with 1 portion of Debt and 2 portions of Equity. It will be subject to a 40% tax on its profit. The cost of debt for this project would be 9% per annum.

15 points Consider the following information and data given in the table below in this section and answer the following questions: Company A is into automobile manufacturing business and has a total of 100,000 shares outstanding issued at a price of INR 10 per share. Its current market price is INR 100 per share. It also has a bank debt of INR 50,00,000 and is subject to a 40% corporate income tax on profit. Equity beta for Company A is 1.28 while the market-wide rf is projected to be at 6% per- annum for all terms depicting a flat yield curve for all foreseeable durations. Expected returns on the market portfolio is expected to remain at 12% per-annum. Company A is now considering diversification by investing in an airline project. Company A considers the following firms (Company X, Y and Z) in the airline industry with the assigned business risk weights (given in the table) for defining the composition of the business risk of the proposed airline project. The new project would be financed with 1 portion of Debt and 2 portions of Equity. It will be subject to a 40% tax on its profit. The cost of debt for this project would be 9% per annum. rate risk Market Corporate Proposed New Book value price of Book value of income airline business No. of of each each debt (equal tax shares outstanding outstanding to the market for the Equity composition Company outstanding share share value of debt) company Beta Weights X 1500000 100 15000000 20% 1.5 0.3 Y 1000000 10 50 25000000 40% 2.1 0.6 Z 2000000 10 200 100000000 30% 0.9 0.1 1 10 1.90 1.46 1.28 1.26 1.47 0.1741 0.1580 0.1234 0.13.40 What is the expected return on equity for the proposed airline project if CAPM holds? O What is the Equity beta for the proposed airline project? What equity beta value is correct for Company A if investing in the pre- existing business with the pre- existing market value D/E mix? O What is the industry Asset beta as per the Proposed New airline business risk composition Weights? What is the WACC for the proposed airline project, if the CAPM holds? 15 points Consider the following information and data given in the table below in this section and answer the following questions: Company A is into automobile manufacturing business and has a total of 100,000 shares outstanding issued at a price of INR 10 per share. Its current market price is INR 100 per share. It also has a bank debt of INR 50,00,000 and is subject to a 40% corporate income tax on profit. Equity beta for Company A is 1.28 while the market-wide rf is projected to be at 6% per- annum for all terms depicting a flat yield curve for all foreseeable durations. Expected returns on the market portfolio is expected to remain at 12% per-annum. Company A is now considering diversification by investing in an airline project. Company A considers the following firms (Company X, Y and Z) in the airline industry with the assigned business risk weights (given in the table) for defining the composition of the business risk of the proposed airline project. The new project would be financed with 1 portion of Debt and 2 portions of Equity. It will be subject to a 40% tax on its profit. The cost of debt for this project would be 9% per annum. rate risk Market Corporate Proposed New Book value price of Book value of income airline business No. of of each each debt (equal tax shares outstanding outstanding to the market for the Equity composition Company outstanding share share value of debt) company Beta Weights X 1500000 100 15000000 20% 1.5 0.3 Y 1000000 10 50 25000000 40% 2.1 0.6 Z 2000000 10 200 100000000 30% 0.9 0.1 1 10 1.90 1.46 1.28 1.26 1.47 0.1741 0.1580 0.1234 0.13.40 What is the expected return on equity for the proposed airline project if CAPM holds? O What is the Equity beta for the proposed airline project? What equity beta value is correct for Company A if investing in the pre- existing business with the pre- existing market value D/E mix? O What is the industry Asset beta as per the Proposed New airline business risk composition Weights? What is the WACC for the proposed airline project, if the CAPM holds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts