Question: Please show me the answer for the question a (ii) Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 April

Please show me the answer for the question a (ii) Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 April 2021

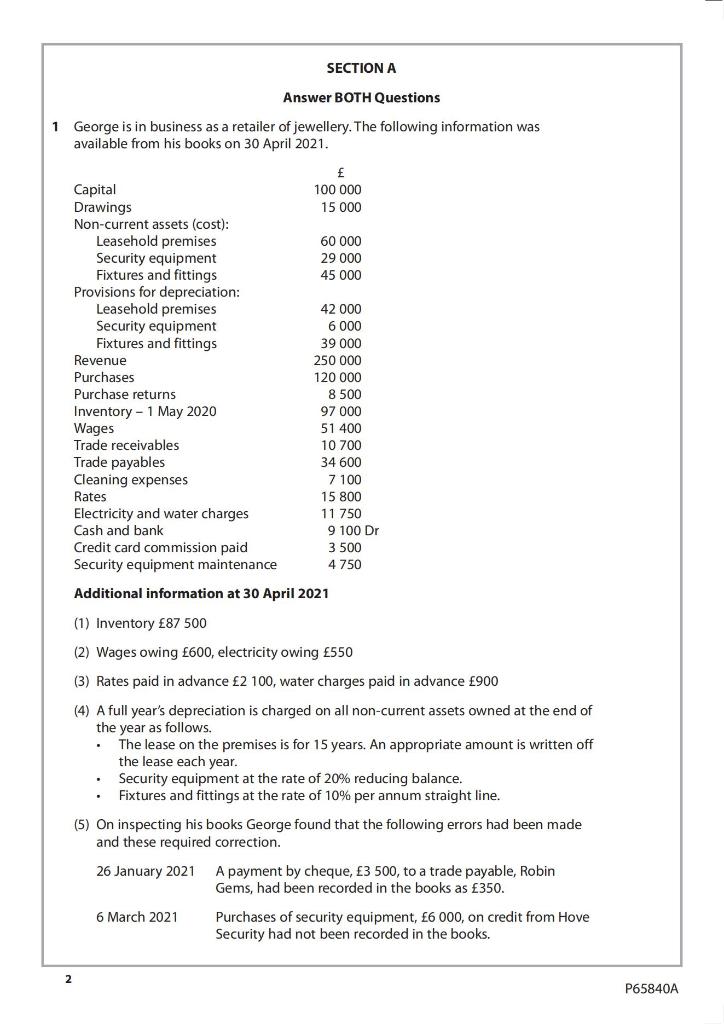

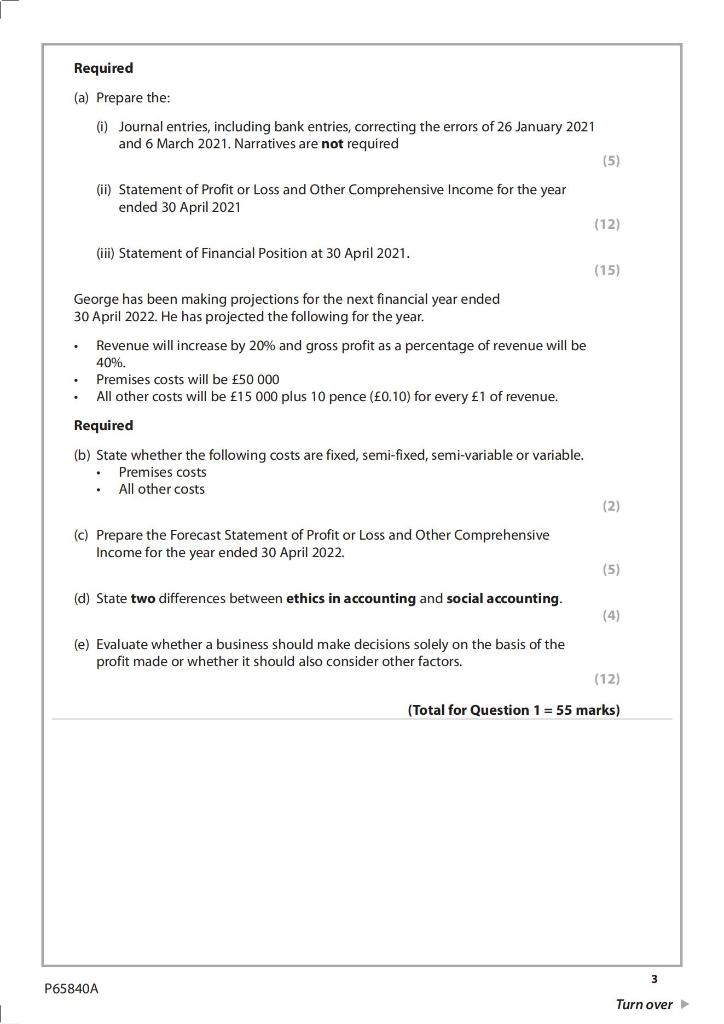

SECTION A Answer BOTH Questions 1 George is in business as a retailer of jewellery. The following information was available from his books on 30 April 2021. 100 000 15 000 60 000 29 000 45 000 Capital Drawings Non-current assets (cost): Leasehold premises Security equipment Fixtures and fittings Provisions for depreciation: Leasehold premises Security equipment Fixtures and fittings Revenue Purchases Purchase returns Inventory - 1 May 2020 Wages Trade receivables Trac Cleaning expenses Rates Electricity and water charges Cash and bank Credit card commission paid Security equipment maintenance 42 000 6 000 39 000 250 000 120 000 8 500 97 000 51 400 10 700 34 600 7 100 15 800 11 750 9 100 Dr 3 500 4750 Additional information at 30 April 2021 . (1) Inventory 87 500 (2) Wages owing 600, electricity owing 550 (3) Rates paid in advance 2 100, water charges paid in advance 900 (4) A full year's depreciation is charged on all non-current assets owned at the end of the year as follows. The lease on the premises is for 15 years. An appropriate amount is written off the lease each year. Security equipment at the rate of 20% reducing balance. Fixtures and fittings at the rate of 10% per annum straight line. (5) On inspecting his books George found that the following errors had been made and these required correction. 26 January 2021 A payment by cheque, 3 500, to a trade payable, Robin Gems, had been recorded in the books as 350. 6 March 2021 Purchases of security equipment, 6 000, on credit from Hove Security had not been recorded in the books, 2 P65840A Required (a) Prepare the: (0) Journal entries, including bank entries, correcting the errors of 26 January 2021 and 6 March 2021. Narratives are not required (5) (ii) Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 April 2021 (12) (iii) Statement of Financial Position at 30 April 2021. (15) George has been making projections for the next financial year ended 30 April 2022. He has projected the following for the year. Revenue will increase by 20% and gross profit as a percentage of revenue will be 40%. Premises costs will be 50 000 All other costs will be 15 000 plus 10 pence (0.10) for every 1 of revenue. Required (b) State whether the following costs are fixed, semi-fixed, semi-variable or variable. Premises costs All other costs (2) (c) Prepare the Forecast Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 April 2022. (5) (d) State two differences between ethics in accounting and social accounting. (4) (e) Evaluate whether a business should make decisions solely on the basis of the profit made or whether it should also consider other factors. (12) (Total for Question 1 = 55 marks) P65840A 1 Turn over

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts