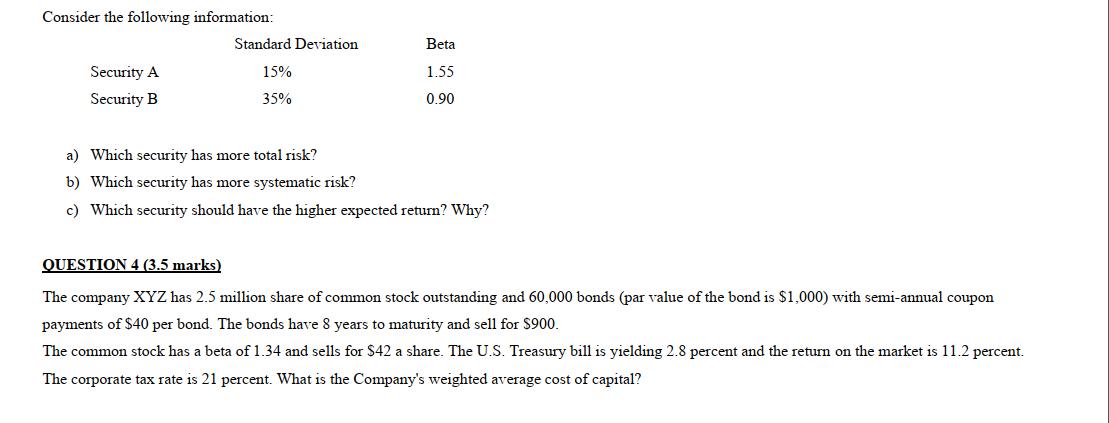

Question: Consider the following information: Security A Security B Standard Deviation 15% 35% Beta 1.55 0.90 a) Which security has more total risk? b) Which

Consider the following information: Security A Security B Standard Deviation 15% 35% Beta 1.55 0.90 a) Which security has more total risk? b) Which security has more systematic risk? c) Which security should have the higher expected return? Why? QUESTION 4 (3.5 marks) The company XYZ has 2.5 million share of common stock outstanding and 60,000 bonds (par value of the bond is $1,000) with semi-annual coupon payments of $40 per bond. The bonds have 8 years to maturity and sell for $900. The common stock has a beta of 1.34 and sells for $42 a share. The U.S. Treasury bill is yielding 2.8 percent and the return on the market is 11.2 percent. The corporate tax rate is 21 percent. What is the Company's weighted average cost of capital?

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

a Security B has more total risk because it has a higher standard deviation of 35 compared to Security As 15 b Security B has more systematic risk bec... View full answer

Get step-by-step solutions from verified subject matter experts