Question: Systematic versus Unsystematic Risk Consider the following information about Stocks I and II: The market risk premium is 8 percent, and the risk-free rate is

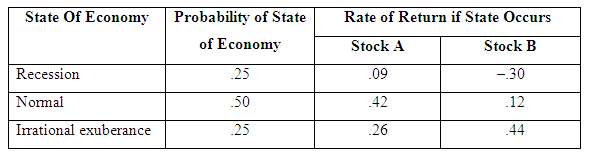

Systematic versus Unsystematic Risk Consider the following information about Stocks I and II:

The market risk premium is 8 percent, and the risk-free rate is 4 percent. Which stock has the most systen1aic risk? Which one has the most unsystematic risk? Which stock is ??riskier??? Explain.

State Of Economy Probability of State Rate of Return if State Occurs of Economy Stock B Stock A Recession 25 .09 -30 50 42 .12 Normal Irational exuberance 25 26 44

Step by Step Solution

3.39 Rating (168 Votes )

There are 3 Steps involved in it

The amount of systematic risk is measured by the of an asset Since we know the market risk premium a... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

29-B-C-F-R-A-R (67).docx

120 KBs Word File