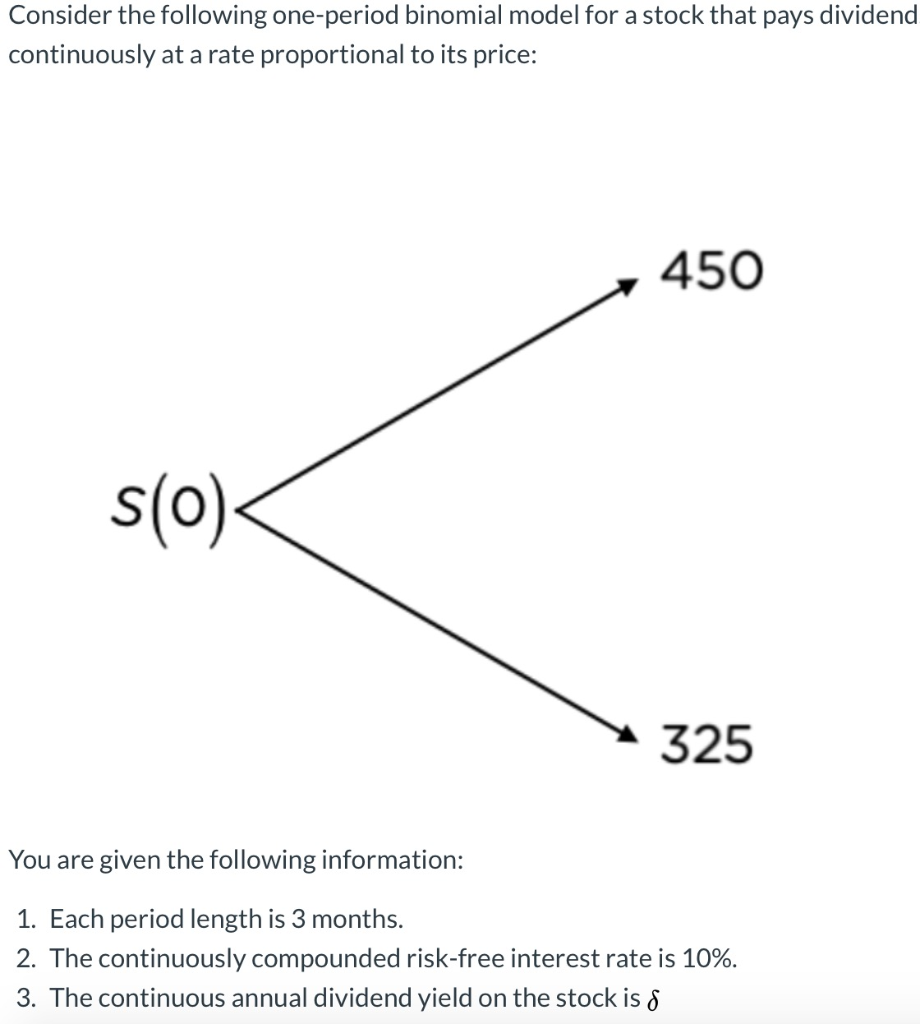

Question: Consider the following one-period binomial model for a stock that pays dividend continuously at a rate proportional to its price: 450 450 s(0) 325 You

Consider the following one-period binomial model for a stock that pays dividend continuously at a rate proportional to its price: 450 450 s(0) 325 You are given the following information: 1. Each period length is 3 months. 2. The continuously compounded risk-free interest rate is 10%. 3. The continuous annual dividend yield on the stock is 8 An investor wishes to replicate a 3-month European call option on the stock with a strike price of $350. Determine the amount in dollars the investor must lend at the risk-free rate. 0 -253.58 0 -235.26 oo 0 235.26 o It cannot be determined from the information given above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock