Question: Consider the following option strategy using four (4) option contracts (all 60-days-expiry- European options). Sell (short) 1 put X- price $1.20/E (or 120) at $0.08

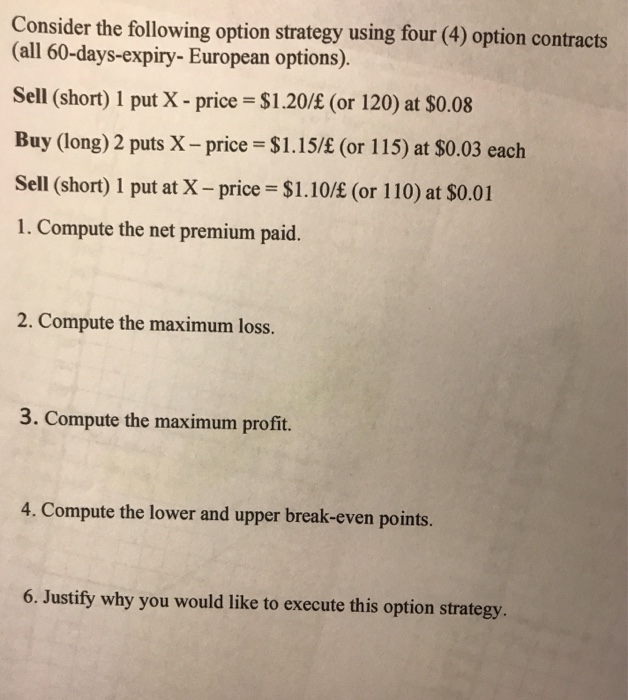

Consider the following option strategy using four (4) option contracts (all 60-days-expiry- European options). Sell (short) 1 put X- price $1.20/E (or 120) at $0.08 Buy (long) 2 puts X - price $1.15/E (or 115) at $0.03 each Sell (short) 1 put at X-price $1.10/ (or 110) at $0.01 1. Compute the net premium paid. 2. Compute the maximum loss. 3. Compute the maximum profit. 4. Compute the lower and upper break-even points. 6. Justify why you would like to execute this option strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts