Question: Consider the following option strategy using four (4) option contracts (all 60-days-expiry- European options) Sell (short) 1 put X - price $1.20/8 (or 120) at

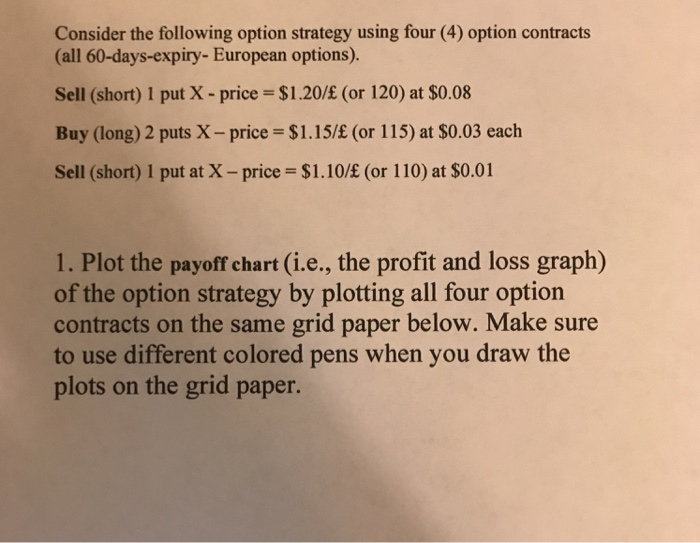

Consider the following option strategy using four (4) option contracts (all 60-days-expiry- European options) Sell (short) 1 put X - price $1.20/8 (or 120) at $0.08 Buy (long) 2 puts X-price $1.15/E (or 115) at $0.03 each Sell (short) 1 put at X - price $1.10/E (or 110) at $0.01 1. Plot the payoff chart (i.e., the profit and loss graph) of the option strategy by plotting all four option contracts on the same grid paper below. Make sure to use different colored pens when you draw the plots on the grid paper

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts