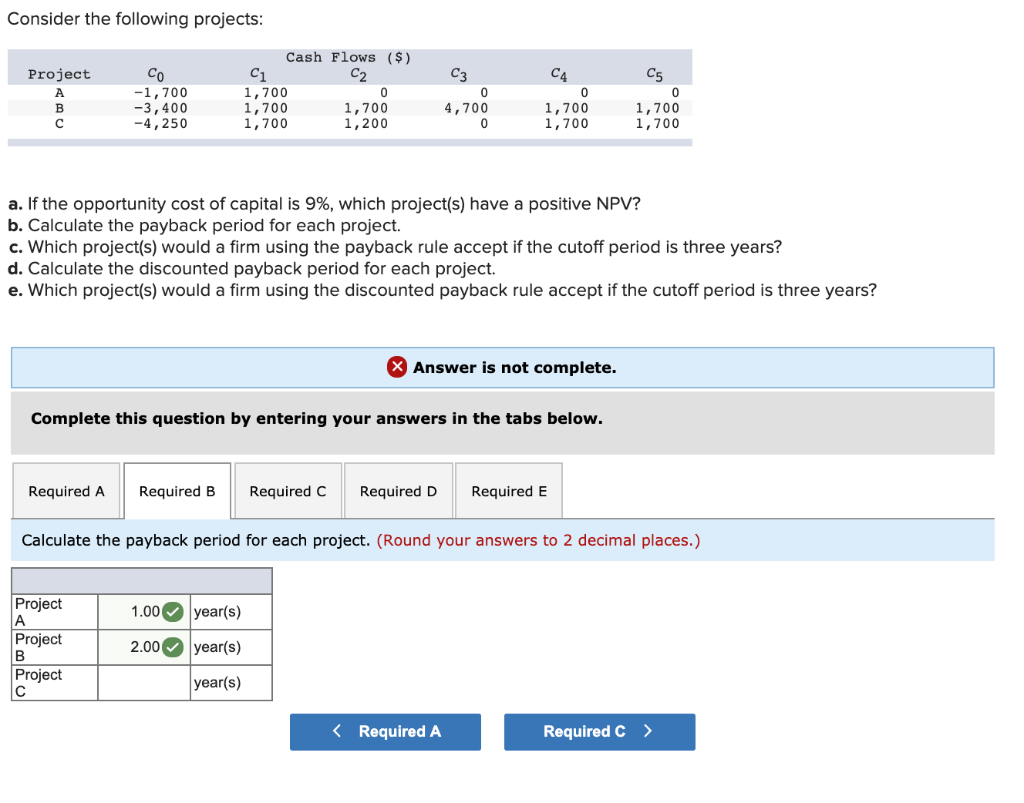

Question: Consider the following projects: C5 Project A B -1,700 -3, 400 -4,250 Cash Flows ($) C1 C2 1,700 0 1,700 1,700 1,700 1,200 0 C3

Consider the following projects: C5 Project A B -1,700 -3, 400 -4,250 Cash Flows ($) C1 C2 1,700 0 1,700 1,700 1,700 1,200 0 C3 0 4,700 0 C4 0 1,700 1,700 1,700 1,700 a. If the opportunity cost of capital is 9%, which project(s) have a positive NPV? b. Calculate the payback period for each project. c. Which project(s) would a firm using the payback rule accept if the cutoff period is three years? d. Calculate the discounted payback period for each project. e. Which project(s) would a firm using the discounted payback rule accept if the cutoff period is three years? X Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Calculate the payback period for each project. (Round your answers to 2 decimal places.) 1.00 year(s) Project Project B Project 2.00 year(s) year(s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts