Question: Consider the following statements, 1. In a strong form efficient market, only insider trading can beat the market. II. In a semi-strong form efficient market,

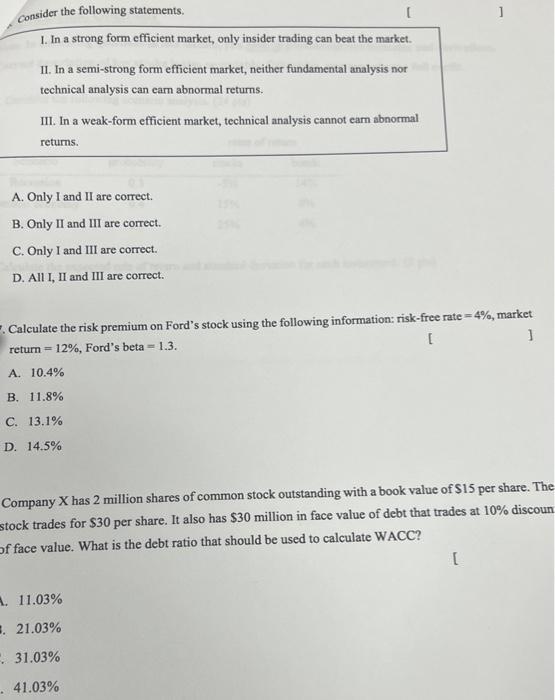

Consider the following statements, 1. In a strong form efficient market, only insider trading can beat the market. II. In a semi-strong form efficient market, neither fundamental analysis nor technical analysis can earn abnormal returns. III. In a weak-form efficient market, technical analysis cannot earn abnormal returns. A. Only I and II are correct. B. Only II and III are correct. C. Only I and III are correct. D. All I, II and III are correct. Calculate the risk premium on Ford's stock using the following information: risk-free rate=4%, market return = 12%, Ford's beta = 1.3. ] A. 10.4% B. 11.8% C. 13.1% D. 14.5% Company X has 2 million shares of common stock outstanding with a book value of $15 per share. The stock trades for $30 per share. It also has $30 million in face value of debt that trades at 10% discoun of face value. What is the debt ratio that should be used to calculate WACC? [ 11.03% . 21.03% 31.03% . 41.03%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts