Question: Consider the following statements made about EBCT Model 1. (a) e represents the 'true' risk premium for a given risk. (b) The variance of

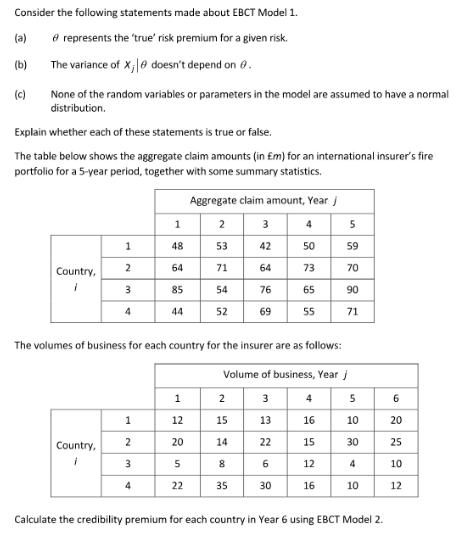

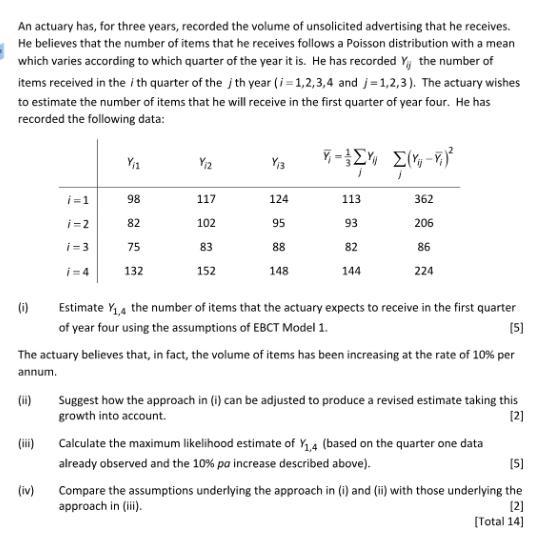

Consider the following statements made about EBCT Model 1. (a) e represents the 'true' risk premium for a given risk. (b) The variance of X; doesn't depend on 6. (c) None of the random variables or parameters in the model are assumed to have a normal distribution. Explain whether each of these statements is true or false. The table below shows the aggregate claim amounts (in m) for an international insurer's fire portfolio for a 5-year period, together with some summary statistics. Country, 1 2 Country, 3 4 1 2 3 1 48 4 64 85 44 1 The volumes of business for each country for the insurer are as follows: Volume of business, Year j 3 5 13 10 30 12 20 5 Aggregate claim amount, Year j 2 3 4 53 42 50 71 64 73 76 65 69 55 22 54 52 2 15 14 8 35 22 6 30 4 16 15 12 5 59 16 70 90 71 4 10 Calculate the credibility premium for each country in Year 6 using EBCT Model 2. 6 2292 20 25 10 12 An actuary has, for three years, recorded the volume of unsolicited advertising that he receives. He believes that the number of items that he receives follows a Poisson distribution with a mean which varies according to which quarter of the year it is. He has recorded Y, the number of items received in the i th quarter of the j th year (i=1,2,3,4 and j=1,2,3). The actuary wishes to estimate the number of items that he will receive in the first quarter of year four. He has recorded the following data: (i) i=1 i=2 i=3 i=4 (iv) Y1 98 82 75 132 Y/2 117 102 83 152 Y3 124 95 88 148 *-(4) 1 113 93 82 144 362 206 86 224 Estimate Y,4 the number of items that the actuary expects to receive in the first quarter of year four using the assumptions of EBCT Model 1. [5] The actuary believes that, in fact, the volume of items has been increasing at the rate of 10% per annum. (ii) Suggest how the approach in (i) can be adjusted to produce a revised estimate taking this growth into account. [2] Calculate the maximum likelihood estimate of Y,4 (based on the quarter one data already observed and the 10% pa increase described above). [5] Compare the assumptions underlying the approach in (i) and (ii) with those underlying the approach in (iii). [2] [Total 14]

Step by Step Solution

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Lets go through each statement and determine whether it is true or false a represents the true risk premium for a given risk This statement is unclear ... View full answer

Get step-by-step solutions from verified subject matter experts