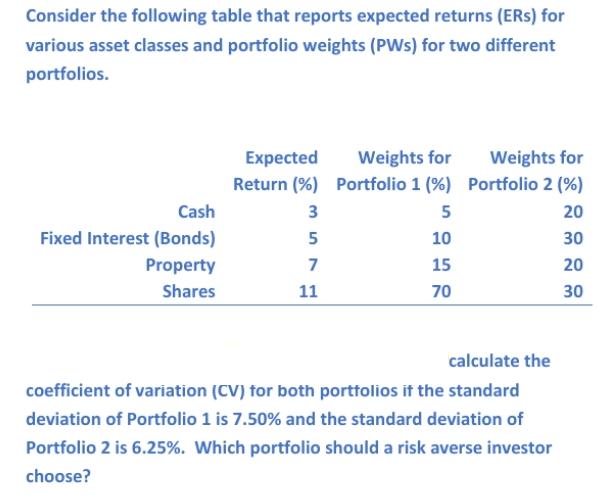

Question: Consider the following table that reports expected returns (ERS) for various asset classes and portfolio weights (PWs) for two different portfolios. Cash Fixed Interest

Consider the following table that reports expected returns (ERS) for various asset classes and portfolio weights (PWs) for two different portfolios. Cash Fixed Interest (Bonds) Property Shares Expected Return (%) 3 5 7 11 Weights for Portfolio 1 (%) 5 10 15 70 Weights for Portfolio 2 (%) 20 30 20 30 calculate the coefficient of variation (CV) for both portfolios if the standard deviation of Portfolio 1 is 7.50% and the standard deviation of Portfolio 2 is 6.25%. Which portfolio should a risk averse investor choose?

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

The coefficient of variation CV is a measure of the relative risk of an investment or portfolio It i... View full answer

Get step-by-step solutions from verified subject matter experts