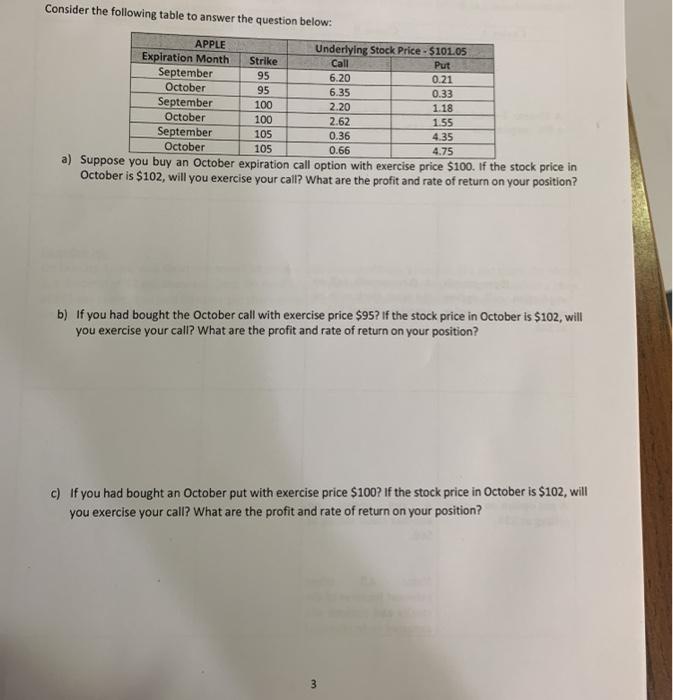

Question: Consider the following table to answer the question below. APPLE Underlying Stock Price $101.05 Expiration Month Strike Call Put September 95 6.20 0.21 October 95

Consider the following table to answer the question below. APPLE Underlying Stock Price $101.05 Expiration Month Strike Call Put September 95 6.20 0.21 October 95 6.35 0.33 September 2.20 1.18 October 100 2.62 1.55 September 105 0.36 4.35 October 105 0.66 4.75 a) Suppose you buy an October expiration call option with exercise price $100. If the stock price in October is $102, will you exercise your call? What are the profit and rate of return on your position? 100 b) If you had bought the October call with exercise price $95? If the stock price in October is $102, will you exercise your call? What are the profit and rate of return on your position? c) If you had bought an October put with exercise price $100? If the stock price in October is $102, will you exercise your call? What are the profit and rate of return on your position? 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts