Question: Consider the following table, which gives a security analyst's expected return on two stocks and the market index in two scenarios: a. What are the

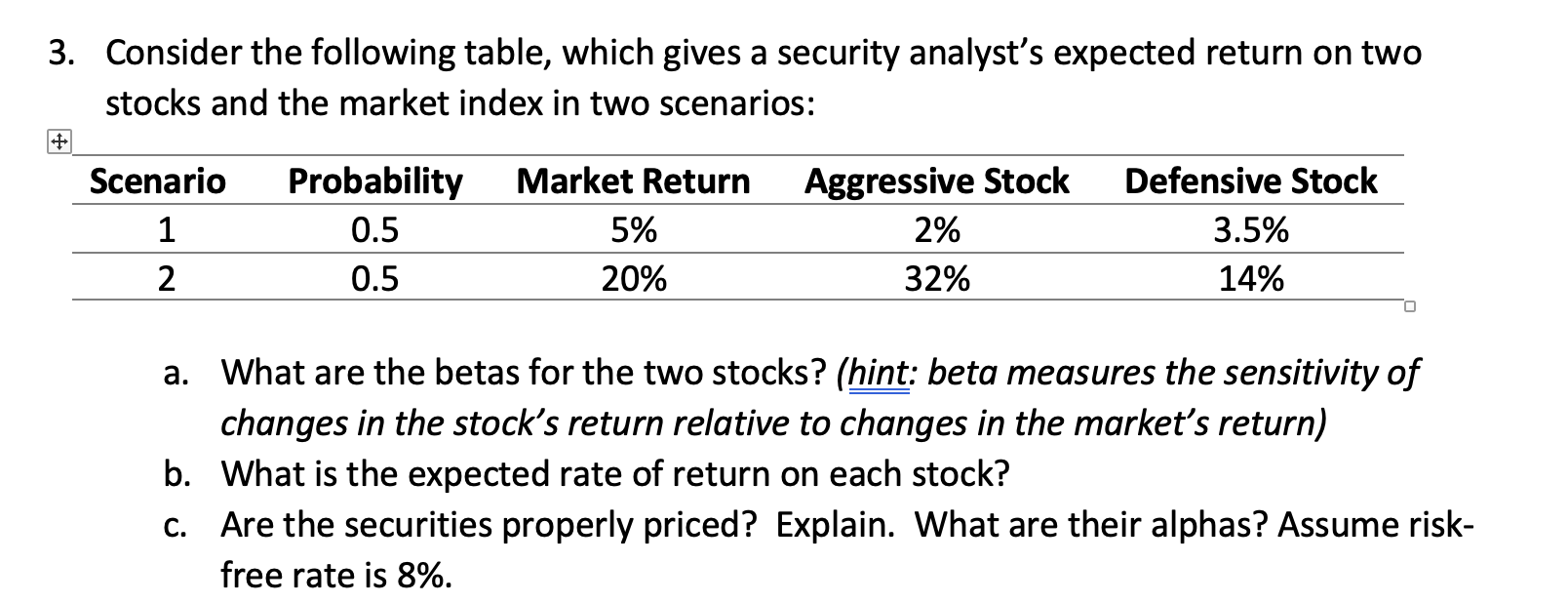

Consider the following table, which gives a security analyst's expected return on two stocks and the market index in two scenarios: a. What are the betas for the two stocks? (hint: beta measures the sensitivity of changes in the stock's return relative to changes in the market's return) b. What is the expected rate of return on each stock? c. Are the securities properly priced? Explain. What are their alphas? Assume riskfree rate is 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts