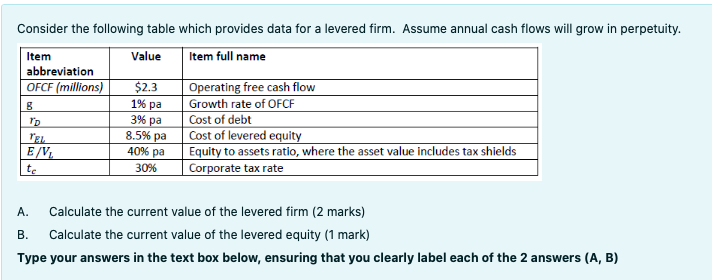

Question: Consider the following table which provides data for a levered firm. Assume annual cash flows will grow in perpetuity. Item Value Item full name abbreviation

Consider the following table which provides data for a levered firm. Assume annual cash flows will grow in perpetuity. Item Value Item full name abbreviation OFCF (millions) $2.3 Operating free cash flow 8 Growth rate of OFCF Cost of debt Tan Cost of levered equity ENV Equity to assets ratio, where the asset value includes tax shields tc 30% Corporate tax rate 1% pa 3% pa 8.5% pa 40% pa A. Calculate the current value of the levered firm (2 marks) B. Calculate the current value of the levered equity (1 mark) Type your answers in the text box below, ensuring that you clearly label each of the 2 answers (A,B)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts