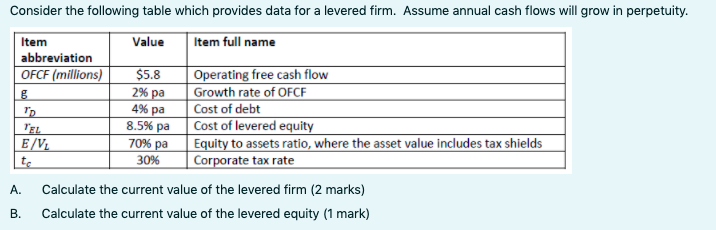

Question: Consider the following table which provides data for a levered firm. Assume annual cash flows will grow in perpetuity. Value Item full name $5.8 Item

Consider the following table which provides data for a levered firm. Assume annual cash flows will grow in perpetuity. Value Item full name $5.8 Item abbreviation OFCF (millions) 6 TEL E/V 2% pa 4% pa 8.5% pa 70% pa Operating free cash flow Growth rate of OFCF Cost of debt Cost of levered equity Equity to assets ratio, where the asset value includes tax shields Corporate tax rate 30% A. Calculate the current value of the levered firm (2 marks) Calculate the current value of the levered equity (1 mark) B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts