Question: 2. Consider the following three models which a researcher can use to model stock market prices: Yt Yt-1 + Ut Yt = 0.5yt-1 +

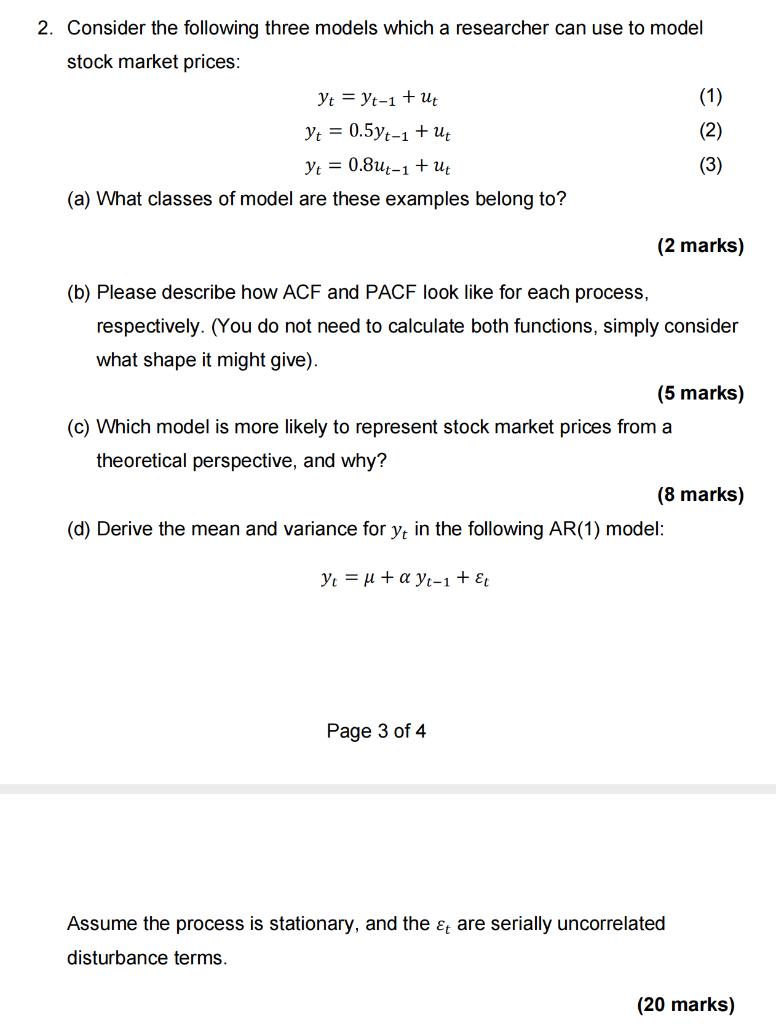

2. Consider the following three models which a researcher can use to model stock market prices: Yt Yt-1 + Ut Yt = 0.5yt-1 + Ut Yt = 0.8ut-1 + Ut (a) What classes of model are these examples belong to? (2 marks) (b) Please describe how ACF and PACF look like for each process, respectively. (You do not need to calculate both functions, simply consider what shape it might give). (c) Which model is more likely to represent stock market prices from a theoretical perspective, and why? Page 3 of 4 (1) (2) (3) (5 marks) (d) Derive the mean and variance for y, in the following AR(1) model: Y = + ayt-1 + Et (8 marks) Assume the process is stationary, and the & are serially uncorrelated disturbance terms. (20 marks)

Step by Step Solution

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts