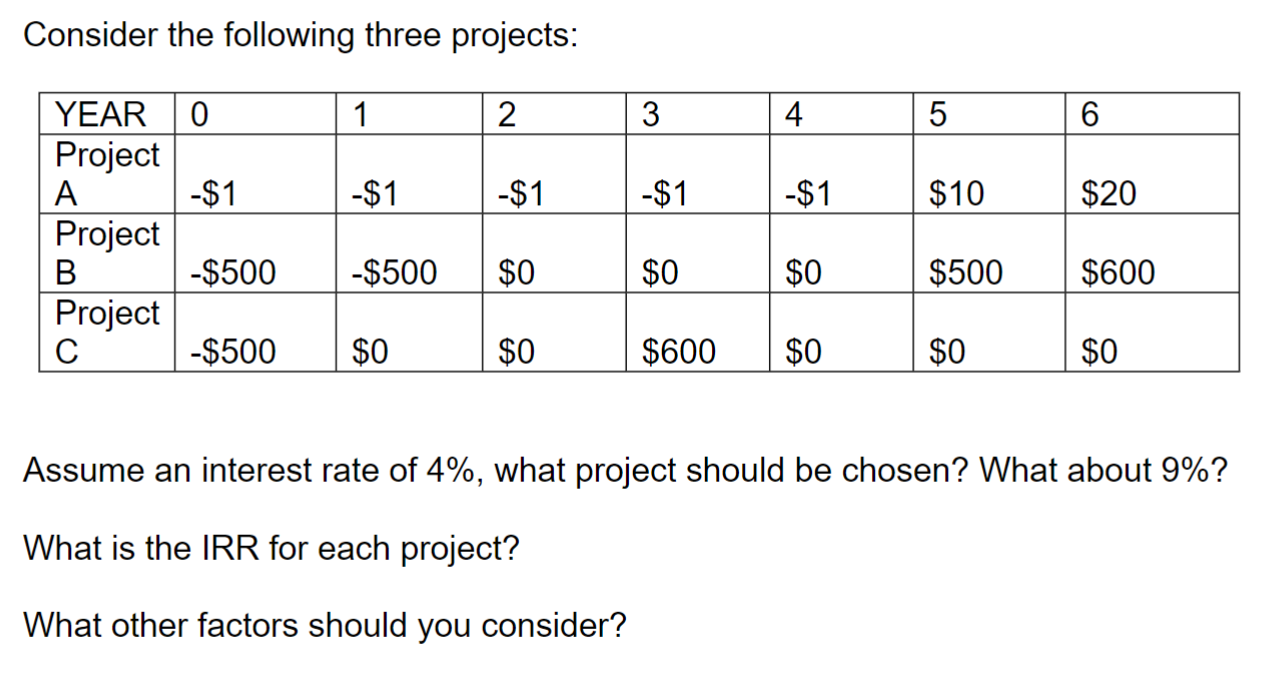

Question: Consider the following three projects: YEAR 0 1 2 3 4 5 6 Project A -$1 -$1 -$1 -$1 -$1 $10 $20 Project B

Consider the following three projects: YEAR 0 1 2 3 4 5 6 Project A -$1 -$1 -$1 -$1 -$1 $10 $20 Project B -$500 -$500 $0 $0 50 $0 $500 $600 Project C -$500 $0 $0 $600 $0 $0 $0 Assume an interest rate of 4%, what project should be chosen? What about 9%? What is the IRR for each project? What other factors should you consider?

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

To determine the best project to choose we need to calculate the net present value NPV of each project at different interest rates The NPV is calculat... View full answer

Get step-by-step solutions from verified subject matter experts