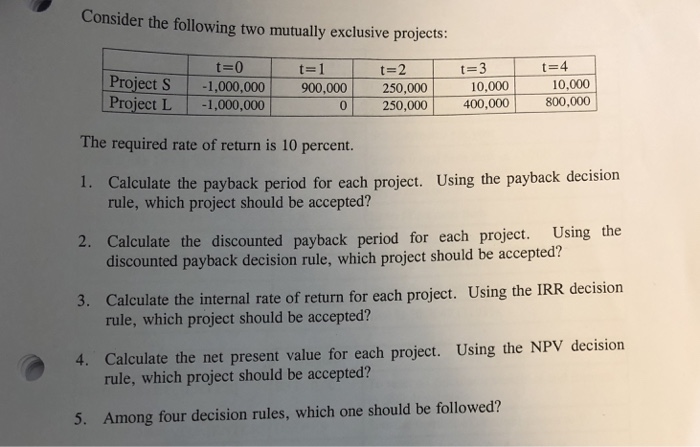

Question: Consider the following two mutually exclusive projects: 10,000 Projects -1,000,000 - 900,001 250,001 400,0001 800,000 Project L 1,000,000 The required rate of return is 10

Consider the following two mutually exclusive projects: 10,000 Projects -1,000,000 - 900,001 250,001 400,0001 800,000 Project L 1,000,000 The required rate of return is 10 percent. 1. Calculate the payback period for each project. Using the payback decision rule, which project should be accepted? 2. C alculate the discounted payback period for each project. Using the discounted payback decision rule, which project should be accepted? Calculate the internal rate of return for each project. Using the IRR decision 3. rule, which project should be accepted? rule, which project should be accepted? Among four decision rules, which one should be followed? 4. Calculate the net present value for each project. Using the NPV decision 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts