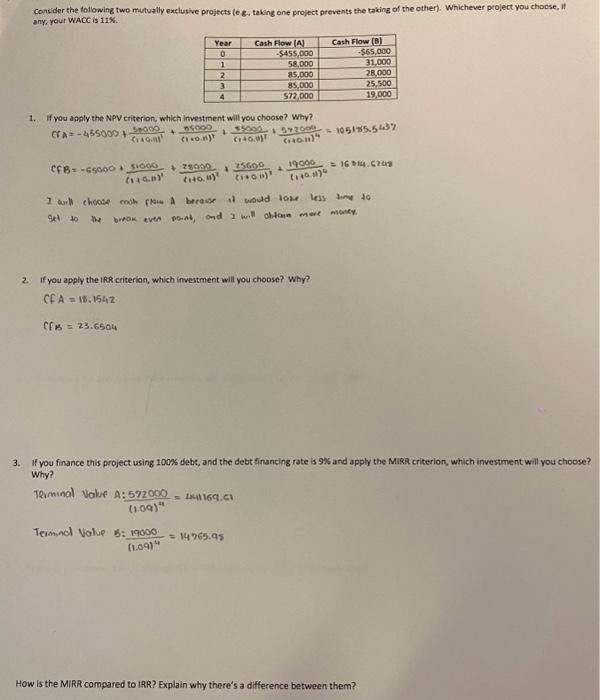

Question: Consider the following two mutually exclusive projects (e s., taking one project prevents the taking of the other). Whichever project you choose, if any, your

Consider the following two mutually exclusive projects (e s., taking one project prevents the taking of the other). Whichever project you choose, if any, your WACC is 11%. 1. If you apply the NPV ctiterion, which imvestment will you choose? Why? 921 to the brok even porat, ond 1 twill obtome mere mover. 2. If you apply the IRR criterion, which investment will you choose? Why? CFA=15.1542CFB=23.6504 3. If you finance this project using 100% debt, and the debt financing rate is 9 s. and apply the MiRR criterion, which investment will you choose? Why? Teimind Volve 5:(1.09)419000=14765.95 How is the MIRR compared to IRR? Explain why there's a difference between them? 4. If you apply the payback criterion, which investment will you choose? Why? S. If you apply the discounted payback criterion, which investment will you choose? Why? 6. If you apply the profitability index criterion, which investment will you choose? Why? 7. Based on your answers in (1) through (6), which project will you finally choose? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts