Question: pls correct the wrong ones if any and shows steps for the incorrect ones Ipoint A stock currently pays no dividends You expect it to

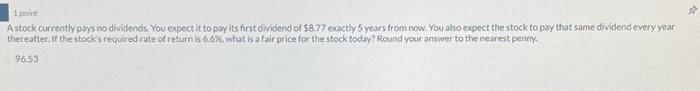

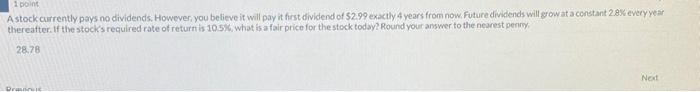

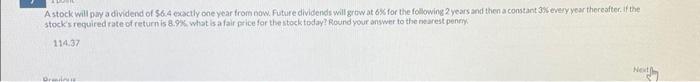

Ipoint A stock currently pays no dividends You expect it to pay its first dividend of $8.77 exactly 5 years from now, You also expect the stock to pay that same dividend every year therealter. If the stock's tequired rate of return is 6.6%, what is a fair price for the stock today? Round your answer to the nearest penny. 96.53 A stock cirrently pays no dividends. However, you be lieve it will pay it first dividend of $2.99 exactly 4 years from now, future dividends will g ow at a constant 2.8% every year thereafter if the stocks required rate of return is 10.5%, what is a fair price for the stock today? Round vour answer to the neanest penny. 2878 A stock will pay a dividend of $6.4 ecoctly one year from now. Future dividends will grow at 6% for the following 2 years and then a constant 35 severy year there after. if the 114.37

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts