Question: Consider the following two mutually exclusive projects. What is the IRR for each project? What is the crossover rate between the two projects? What is

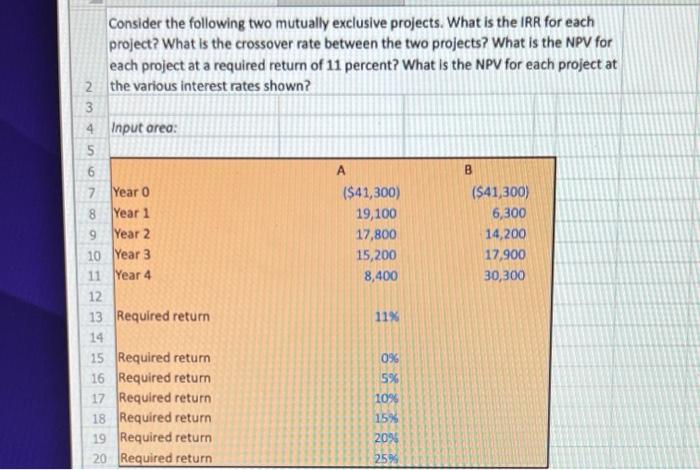

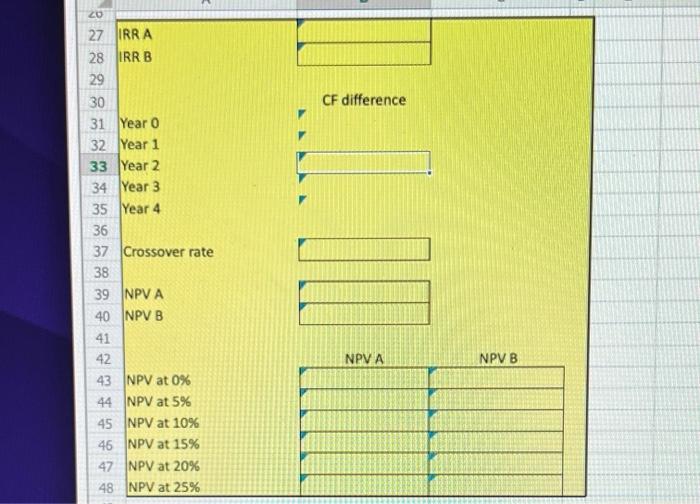

Consider the following two mutually exclusive projects. What is the IRR for each project? What is the crossover rate between the two projects? What is the NPV for each project at a required return of 11 percent? What is the NPV for each project at 2 the various interest rates shown? 3 4 Input area: 5 6 A B 7 Year 0 ($41,300) (541,300) 8 Year 1 19,100 6,300 9 Year 2 17,800 14,200 10 Year 3 15,200 17,900 11 Year 4 8,400 30,300 12 13 Required return 11% 14 15 Required return 096 16 Required return 5% 17 Required return 109 18 Required return 15% 19 Required return 2096 20 Required return 25% CF difference 20 27 IRRA 28 IRRB 29 30 31 Year 0 32 Year 1 33 Year 2 34 Year 3 35 Year 4 36 37 Crossover rate 38 39 NPVA 40 NPVB 41 42 43 NPV at 0% 44 NPV at 5% 45 NPV at 10% 46 NPV at 15% 47 NPV at 20% 48 NPV at 25% JO NPV A NPVB

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts