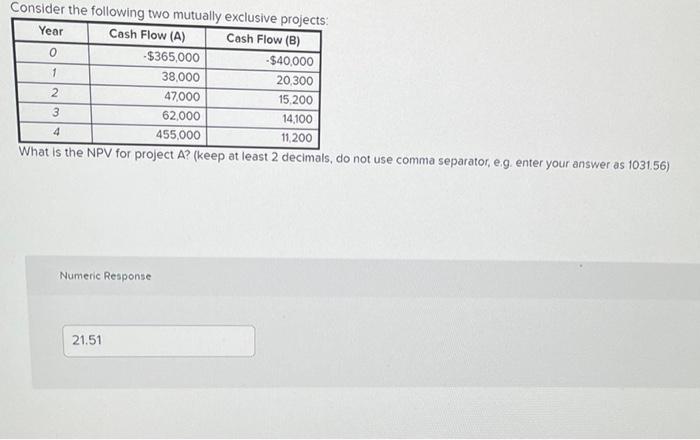

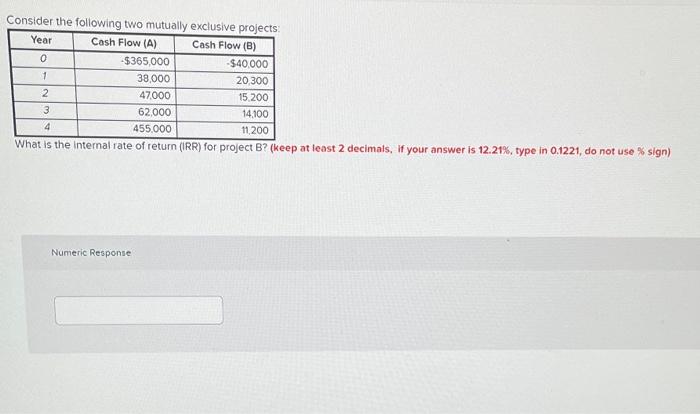

Question: Consider the following two mutually exclusive projects Year Cash Flow (A) Cash Flow (B) 0 -$365,000 -$40,000 1 38,000 20,300 2 47,000 15.200 3 62,000

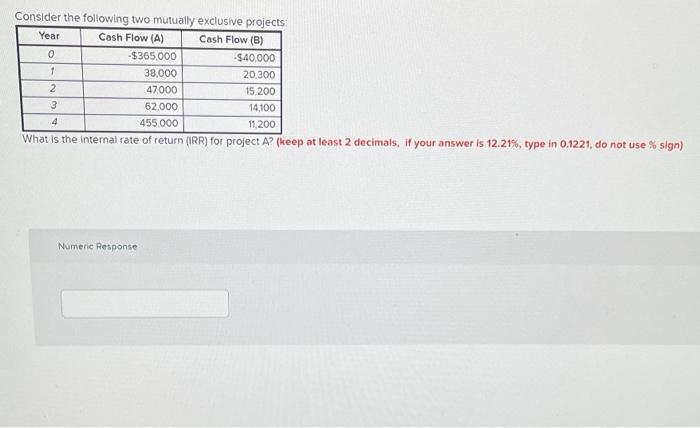

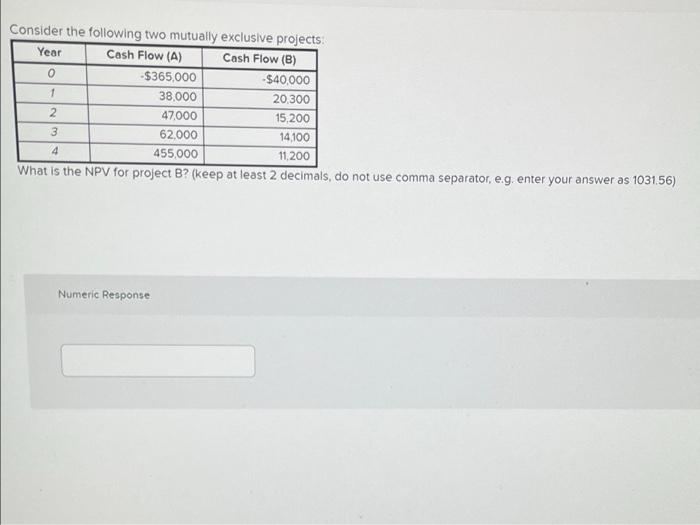

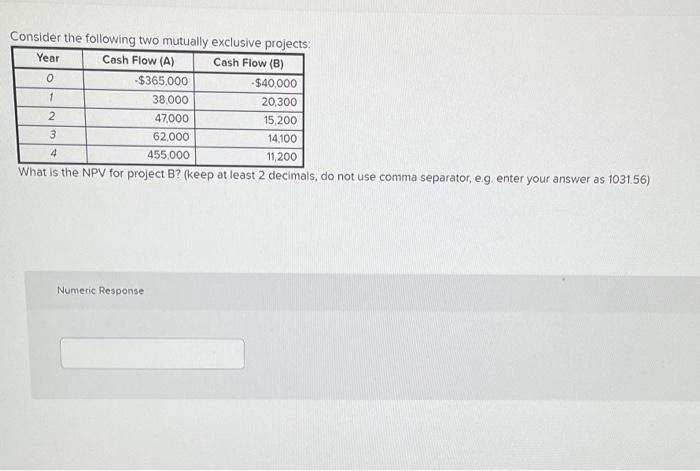

Consider the following two mutually exclusive projects Year Cash Flow (A) Cash Flow (B) 0 -$365,000 -$40,000 1 38,000 20,300 2 47,000 15.200 3 62,000 14100 4 455,000 11,200 What is the NPV for project A? (keep at least 2 decimals, do not use comma separator, eg enter your answer as 103156) Numeric Response 21.51 0 Consider the following two mutually exclusive projects Year Cash Flow (A) Cash Flow (B) -$365,000 $40.000 1 38,000 20,300 2 47000 15,200 3 62.000 14,100 455.000 11.200 What is the internal rate of return (IRR) for project A? (keep at least 2 decimals, if your answer is 12.21%, type in 0.1221, do not use % sign) 4 Numeric Response Consider the following two mutually exclusive projects Year Cash Flow (A) Cash Flow (B) 0 -$365,000 -$40,000 1 38.000 20,300 2 47.000 15,200 3 62.000 14.100 455,000 11,200 What is the NPV for project B? (keep at least 2 decimals, do not use comma separator, eg. enter your answer as 1031.56) 4 Numeric Response Consider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (8) 0 -$365,000 $40,000 1 38.000 20,300 2 47,000 15,200 3 62,000 14,100 4 455 000 11,200 What is the NPV for project B? (keep at least 2 decimals, do not use comma separator, eg enter your answer as 1031.56) Numeric Response 1 Consider the following two mutually exclusive projects Year Cash Flow (A) Cash Flow (B) 0 -$365,000 -$40.000 38,000 20,300 2 47.000 15,200 3 62.000 14.100 4 455.000 11,200 What is the internal rate of return (IRR) for project B? (keep at least 2 decimals, if your answer is 12.21%, type in 0.1221, do not use % sign) Numeric Response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts