Question: (Total: 25 Case Study 3 Marks) Project evaluation You have just been appointed to the newly created financial analyst position with the Australian company, Williams

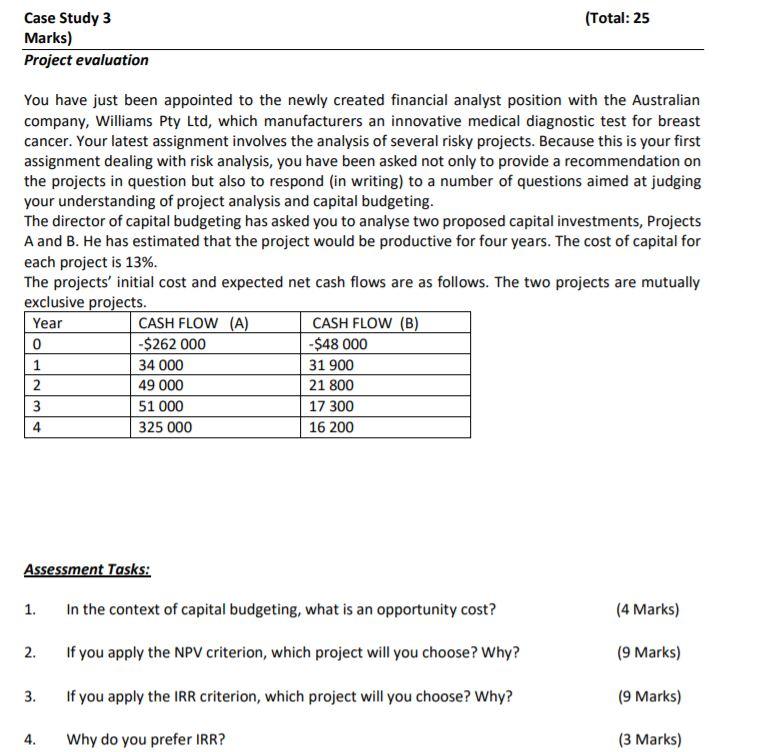

(Total: 25 Case Study 3 Marks) Project evaluation You have just been appointed to the newly created financial analyst position with the Australian company, Williams Pty Ltd, which manufacturers an innovative medical diagnostic test for breast cancer. Your latest assignment involves the analysis of several risky projects. Because this is your first assignment dealing with risk analysis, you have been asked not only to provide a recommendation on the projects in question but also to respond (in writing) to a number of questions aimed at judging your understanding of project analysis and capital budgeting. The director of capital budgeting has asked you to analyse two proposed capital investments, Projects A and B. He has estimated that the project would be productive for four years. The cost of capital for each project is 13%. The projects' initial cost and expected net cash flows are as follows. The two projects are mutually exclusive projects. Year CASH FLOW (A) CASH FLOW (B) 0 $262 000 -$48 000 1 34 000 31 900 2 49 000 21 800 3 51 000 17 300 4 325 000 16 200 Assessment Tasks: 1. In the context of capital budgeting, what is an opportunity cost? (4 Marks) 2. If you apply the NPV criterion, which project will you choose? Why? (9 Marks) 3. If you apply the IRR criterion, which project will you choose? Why? (9 Marks) 4. Why do you prefer IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts