Question: Consider the following two probability distributions of expected future returns for stocks A and B: Ch 08- Video Lesson - Risk and Rates of Return

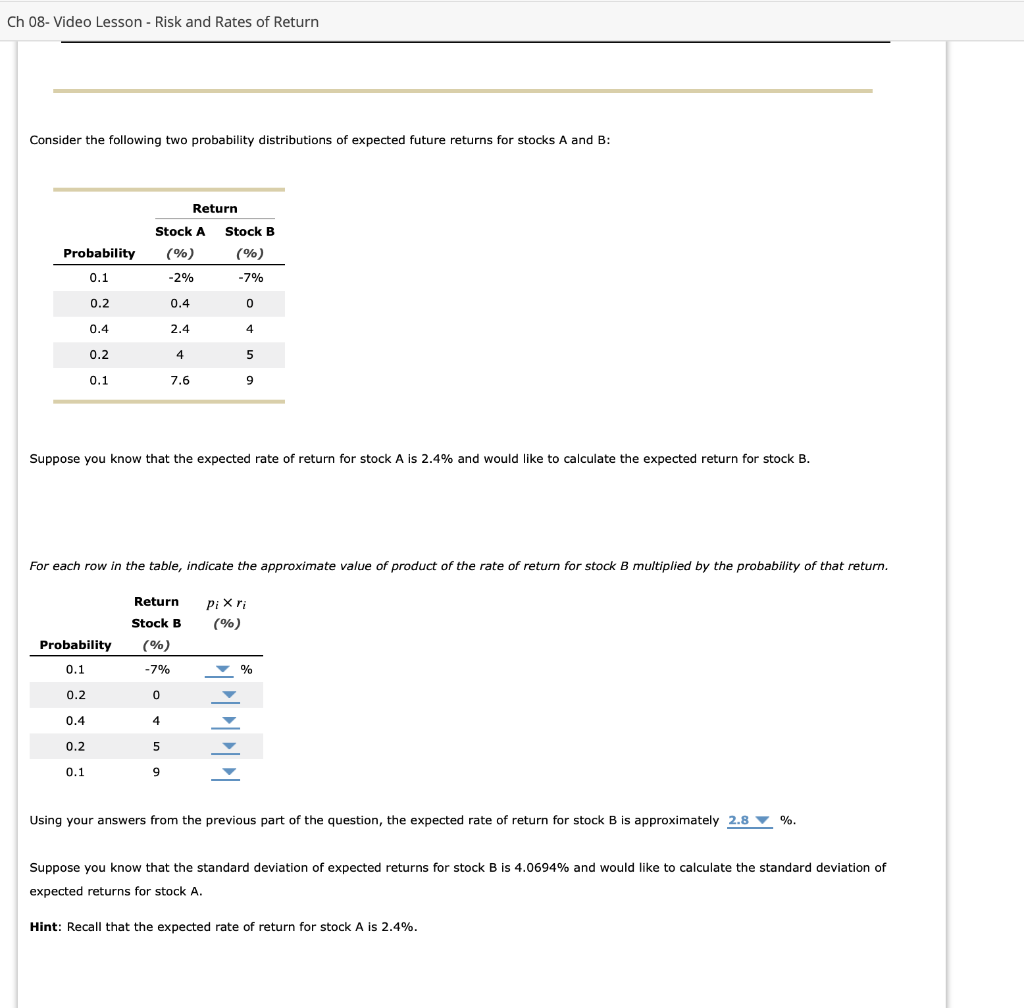

Consider the following two probability distributions of expected future returns for stocks A and B:

Ch 08- Video Lesson - Risk and Rates of Return Consider the following two probability distributions of expected future returns for stocks A and B: Return Stock A Stock B Probability (%) (%) -2% 0.1 -7% 0.2 0.4 0 0.4 2.4 4 0.2 4 5 0.1 7.6 9 Suppose you know that the expected rate of return for stock A is 2.4% and would like to calculate the expected return for stock B. For each row in the table, indicate the approximate value of product of the rate of return for stock B multiplied by the probability of that return. Return Stock B piXri (%) Probability (%) 0.1 -7% % 0.2 0 0.4 4 M 4114 0.2 5 0.1 9 Using your answers from the previous part of the question, the expected rate of return for stock B is approximately 2.8%. Suppose you know that the standard deviation of expected returns for stock B is 4.0694% and would like to calculate the standard deviation of expected returns for stock A. Hint: Recall that the expected rate of return for stock A is 2.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts