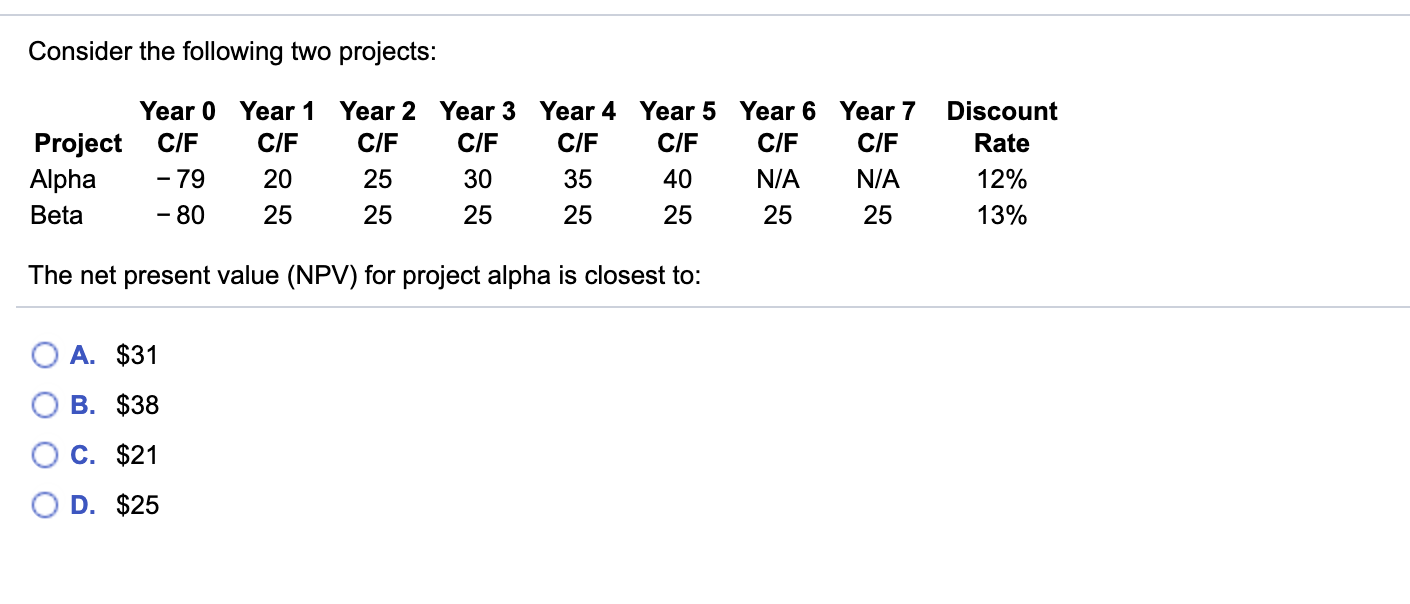

Question: Consider the following two projects: C/F Project Alpha Beta Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7

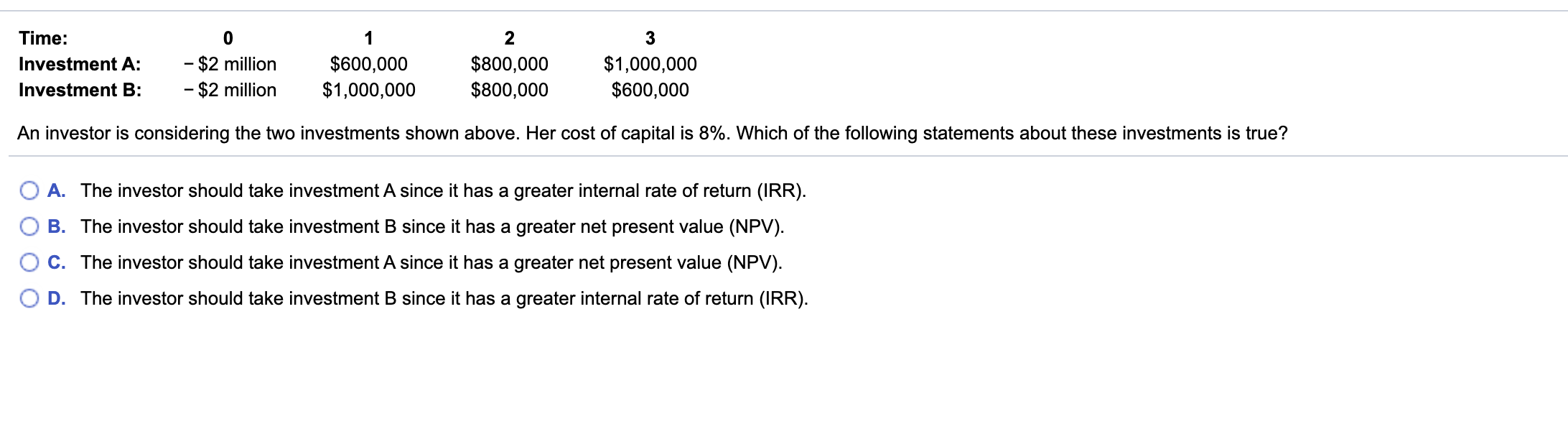

Consider the following two projects: C/F Project Alpha Beta Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 C/F C/F C/F C/F C/F C/F C/F - 79 20 25 30 35 40 -80 25 25 25 25 25 25 25 Discount Rate 12% 13% The net present value (NPV) for project alpha is closest to: A. $31 B. $38 C. $21 OD. $25 Time: Investment A: Investment B: 0 - $2 million - $2 million 1 $600,000 $1,000,000 2 $800,000 $800,000 3 $1,000,000 $600,000 An investor is considering the two investments shown above. Her cost of capital is 8%. Which of the following statements about these investments is true? A. The investor should take investment A since it has a greater internal rate of return (IRR). B. The investor should take investment B since it has a greater net present value (NPV). C. The investor should take investment A since it has a greater net present value (NPV). D. The investor should take investment B since it has a greater internal rate of return (IRR)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts