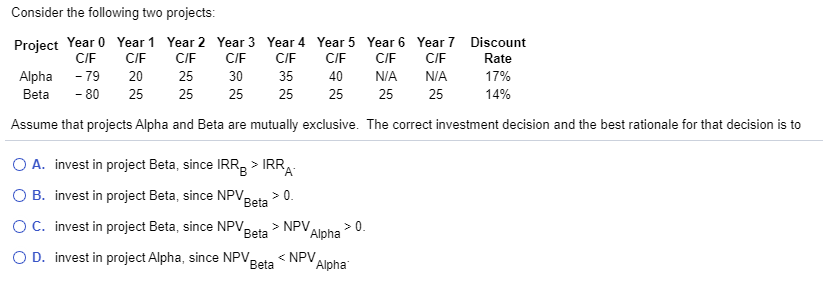

Question: Consider the following two projects: Proiect Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 CIF CIE CIF C/E C/E C/E Alpha

Consider the following two projects: Proiect Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 CIF CIE CIF C/E C/E C/E Alpha - 79 20 25 30 35 40 Beta - 80 25 25 25 25 25 Year 6 Year 7 Discount C/E C/E Rate NA NA 17% 25 25 14% Assume that projects Alpha and Beta are mutually exclusive. The correct investment decision and the best rationale for that decision is to O A. invest in project Beta, since IRR > IRRA OB. invest in project Beta, since NPV Beta >0. OC. invest in project Beta, since NPV Beta > NPV Alpha >0. OD. invest in project Alpha, since NPVBeta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts