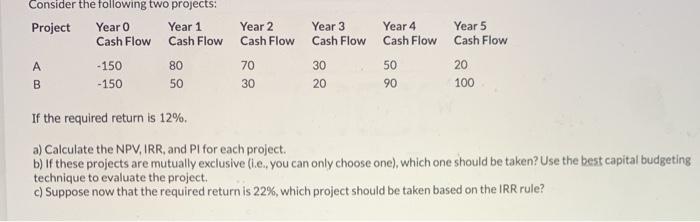

Question: Consider the following two projects: Project Year 0 Year 1 Cash Flow Cash Flow A - 150 80 B -150 50 Year 2 Cash Flow

Consider the following two projects: Project Year 0 Year 1 Cash Flow Cash Flow A - 150 80 B -150 50 Year 2 Cash Flow Year 3 Year 4 Year 5 Cash Flow Cash Flow Cash Flow 30 50 20 20 90 100 70 30 If the required return is 12%. a) Calculate the NPV, IRR, and Pl for each project. b) If these projects are mutually exclusive lile. you can only choose one), which one should be taken? Use the best capital budgeting technique to evaluate the project. c) Suppose now that the required return is 22%, which project should be taken based on the IRR rule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts