Question: Consider the following two projects: table [ [ Project , Year 0 , Year 1 , Year 2 , Year 3 , Year 4

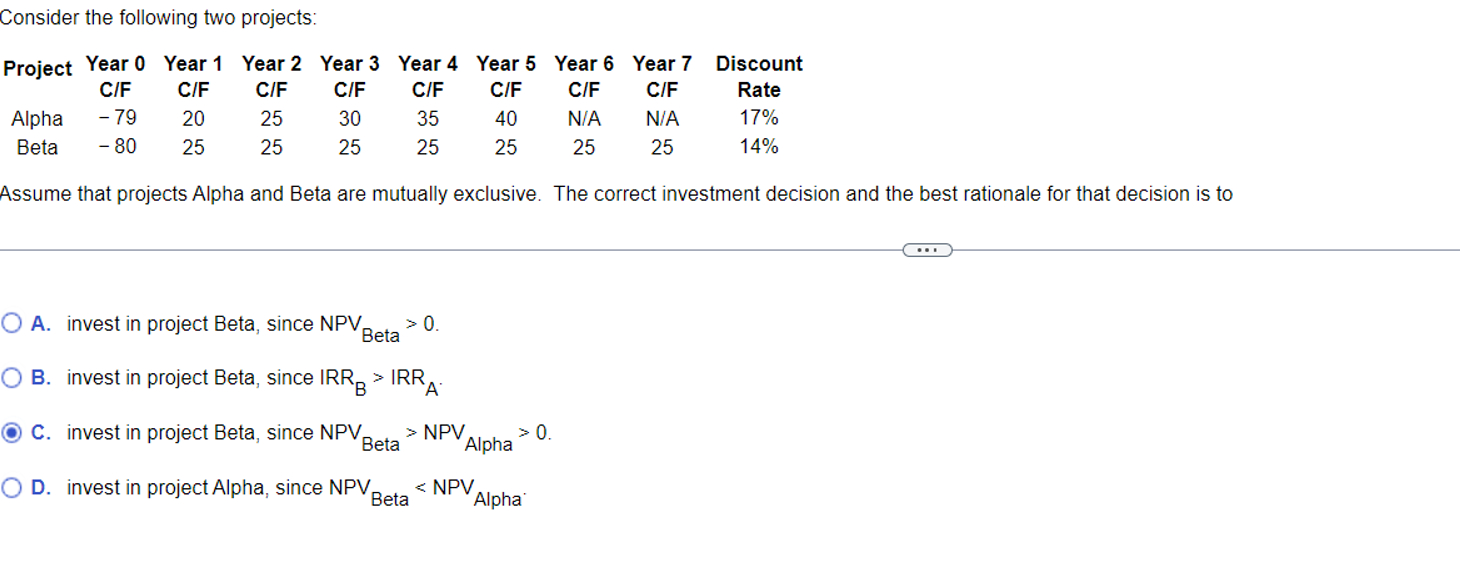

Consider the following two projects:

tableProjectYear Year Year Year Year Year Year Year DiscountCFCFCFCFCFCFCFCFRateAlphaNANABeta

Assume that projects Alpha and Beta are mutually exclusive. The correct investment decision and the best rationale for that decision is to

B invest in project Beta, since

C invest in project Beta, since NPV

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock