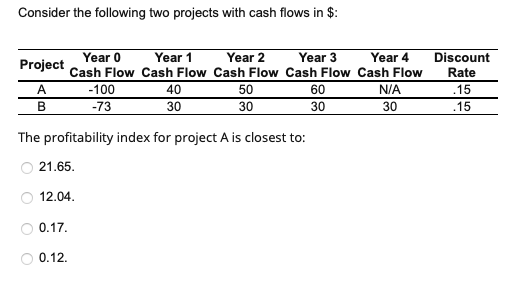

Question: Consider the following two projects with cash flows in $: The profitability index for project A is closest to: 21.65. 12.04 0.17 0.12 payment, Taggart

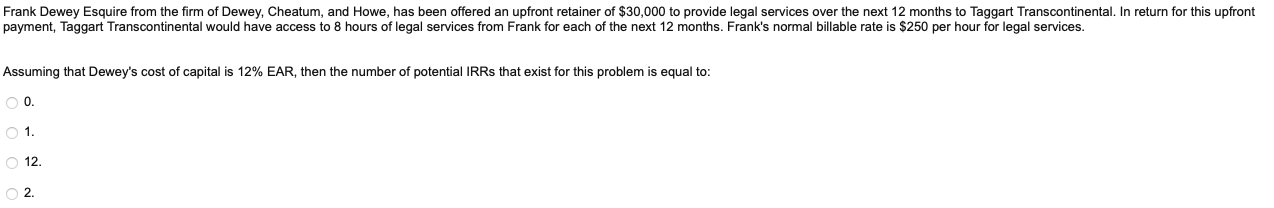

Consider the following two projects with cash flows in \$: The profitability index for project A is closest to: 21.65. 12.04 0.17 0.12 payment, Taggart Transcontinental would have access to 8 hours of legal services from Frank for each of the next 12 months. Frank's normal billable rate is $250 per hour for legal services. Assuming that Dewey's cost of capital is 12% EAR, then the number of potential IRRs that exist for this problem is equal to: 0. 1. 12. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts