Question: I need help with question b & c. WACC-Book weights and market weights Webster Company has compiled the information shown in the following table: B.

I need help with question b & c.

I need help with question b & c.

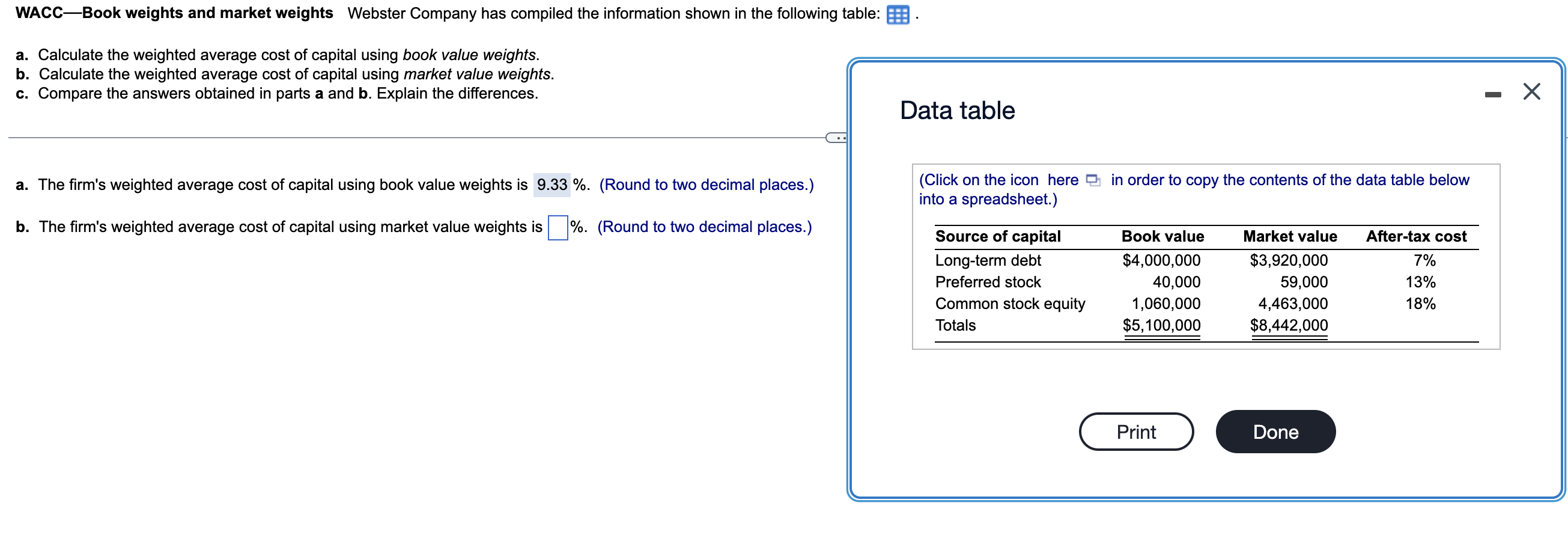

WACC-Book weights and market weights Webster Company has compiled the information shown in the following table: B. a. Calculate the weighted average cost of capital using book value weights. b. Calculate the weighted average cost of capital using market value weights. c. Compare the answers obtained in parts a and b. Explain the differences. Data table a. The firm's weighted average cost of capital using book value weights is 9.33 %. (Round to two decimal places.) in order to copy the contents of the data table below (Click on the icon here into a spreadsheet.) b. The firm's weighted average cost of capital using market value weights is %. (Round to two decimal places.) After-tax cost 7% Source of capital Long-term debt Preferred stock Common stock equity Totals Book value $4,000,000 40,000 1,060,000 $5,100,000 Market value $3,920,000 59,000 4,463,000 $8,442,000 13% 18% Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts