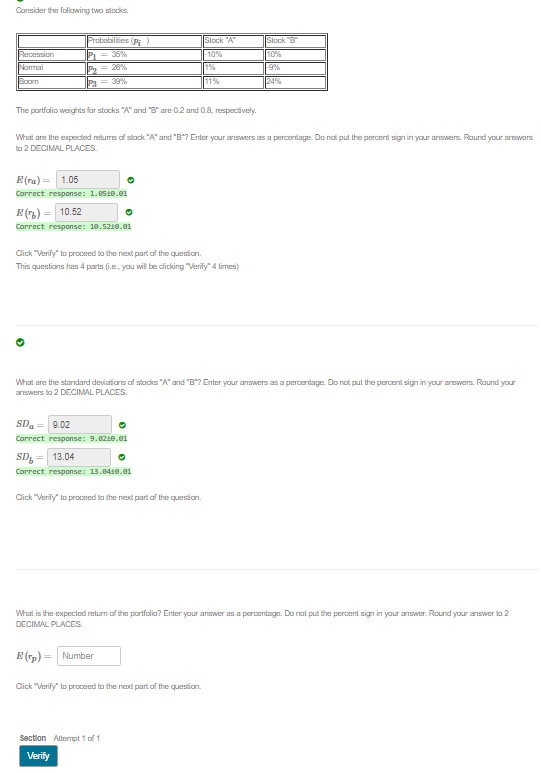

Question: Consider the following two stics Probabilities (Pi) Slock A -10% P= 35% Recession Normal Stock 10% 9% Boom PS 39 1193 The portfolio weights for

Consider the following two stics Probabilities (Pi) Slock "A" -10% P= 35% Recession Normal Stock 10% 9% Boom PS 39 1193 The portfolio weights for stocks "A" and are 0.2 and 0.8, respectively. What are the expected returres of stock "A" and "B? Enter your answers as a percentage. Do not put the percent sign in your answers. Round your answers to 2 DECIMAL PLACES Eva)= 1,08 Correct response: 1.510.01 () = 10.52 Correct response: 10.52.10.01 Click "Verify to proceed to the next part of the question. This questions has 4 parts (ie.. you will be dicking "Verify" 4 times) What are the standard deviations of socks "A" and "B"? Enter your answers as a percentage. Do not put the percent sign in your arewers. Round your B answers to 2 DECIMAL PLACES SD = 9.02 Correct response: 9.620.01 SD, = 13.04 Correct response: 13.0420.01 Click "Verify to proceed to the next part of the question. What is the expected return of the portfolio? Enter your answer as a percentage. Do not put the percent sign in your answer. Round your answer to 2 DECIMAL PLACES (p) = Number Click "Verify to proceed to the next part of the question. Section Alternat 1 of 1 Verify

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts