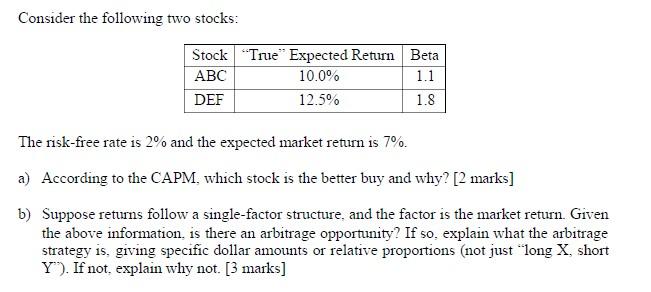

Question: Consider the following two stocks: Stock True Expected Return Beta ABC 1.1 10.0% DEF 12.5% 1.8 The risk-free rate is 2% and the expected market

Consider the following two stocks: Stock "True" Expected Return Beta ABC 1.1 10.0% DEF 12.5% 1.8 The risk-free rate is 2% and the expected market return is 7%. a) According to the CAPM, which stock is the better buy and why? [2 marks] b) Suppose returns follow a single-factor structure, and the factor is the market return. Given the above information, is there an arbitrage opportunity? If so, explain what the arbitrage strategy is, giving specific dollar amounts or relative proportions (not just "long X, short Y"). If not, explain why not. [3 marks] Consider the following two stocks: Stock "True" Expected Return Beta ABC 1.1 10.0% DEF 12.5% 1.8 The risk-free rate is 2% and the expected market return is 7%. a) According to the CAPM, which stock is the better buy and why? [2 marks] b) Suppose returns follow a single-factor structure, and the factor is the market return. Given the above information, is there an arbitrage opportunity? If so, explain what the arbitrage strategy is, giving specific dollar amounts or relative proportions (not just "long X, short Y"). If not, explain why not. [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts