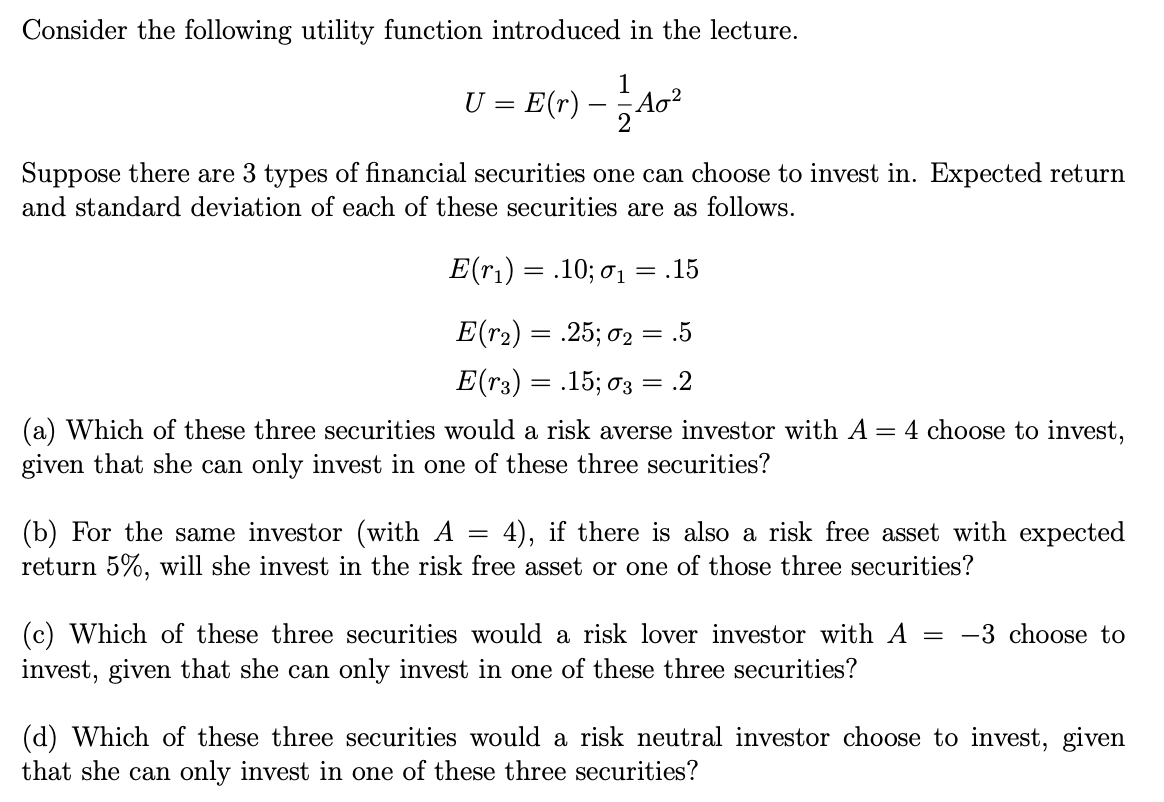

Question: Consider the following utility function introduced in the lecture. 1 U = E(r) A0 Suppose there are 3 types of financial securities one can choose

Consider the following utility function introduced in the lecture. 1 U = E(r) A0 Suppose there are 3 types of financial securities one can choose to invest in. Expected return and standard deviation of each of these securities are as follows. E(ru) = .10; 01 = .15 E(r2) = .25; 02 = .5 E(r3) = .15; 03 = .2 (a) Which of these three securities would a risk averse investor with A = 4 choose to invest, given that she can only invest in one of these three securities? == (b) For the same investor (with A 4), if there is also a risk free asset with expected return 5%, will she invest in the risk free asset or one of those three securities? (c) Which of these three securities would a risk lover investor with A = -3 choose to invest, given that she can only invest in one of these three securities? (d) Which of these three securities would a risk neutral investor choose to invest, given that she can only invest in one of these three securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts