Question: Problem 5. Consider the following utility function for an individual: U = E(r) A0%. Suppose there are 4 types of financial securities one can choose

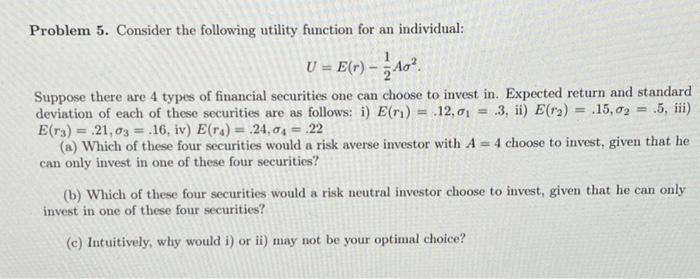

Problem 5. Consider the following utility function for an individual: U = E(r) A0%. Suppose there are 4 types of financial securities one can choose to invest in. Expected return and standard deviation of each of these securities are as follows: i) E(ri) = 12,01 = .3, ii) E(ra) = .15,02 = .5, iii) E(rs) = 21,03 = .16. iv) E(ra) = 24,04 = 22 (a) Which of these four securities would a risk averse investor with A = 4 choose to invest, given that he can only invest in one of these four securities? (b) Which of these four securities would a risk neutral investor choose to invest, given that he can only invest in one of these four securities? (c) Intuitively, why would i) or ii) may not be your optimal choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts