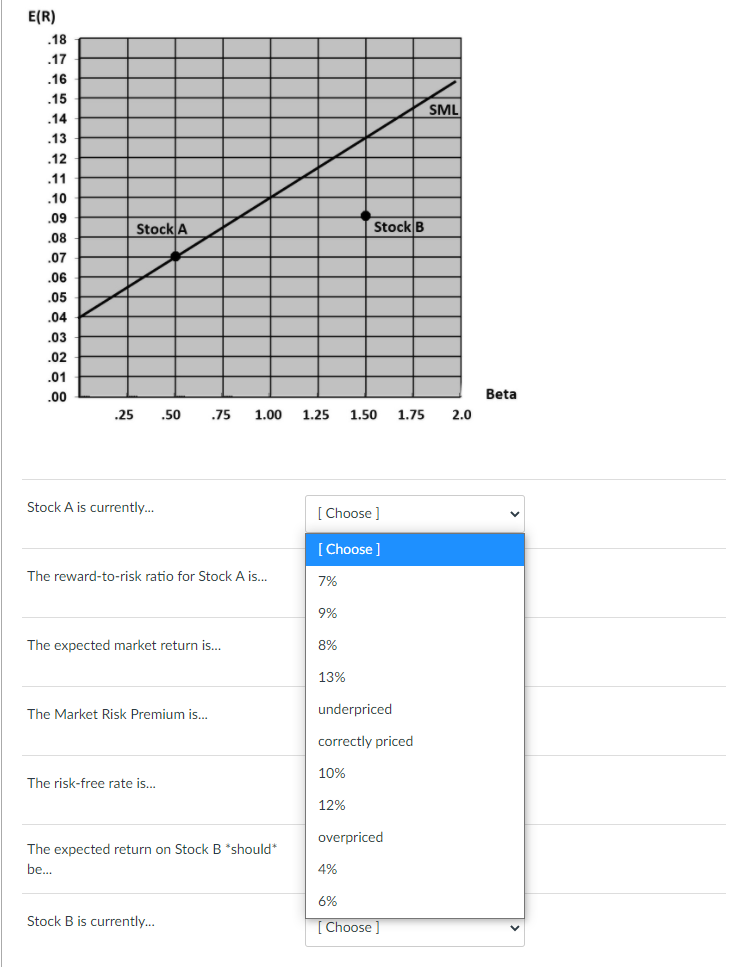

Question: Consider the graph below, and assume the CAPM and SML are valid. Match the following items. You will not use all right-side matches, and it's

Consider the graph below, and assume the CAPM and SML are valid. Match the following items. You will not use all right-side matches, and it's possible that you might use right-side matches more than once.

E(R) SML .18 .17 .16 .15 .14 .13 .12 .11 .10 .09 .08 .07 .06 .05 04 .03 .02 .01 .00 Stock A Stock B Beta .25 .50 .75 1.00 1.25 1.50 1.75 2.0 Stock A is currently... [Choose ] [Choose] The reward-to-risk ratio for Stock A is... 7% 9% The expected market return is... 8% 13% The Market Risk Premium is... underpriced correctly priced 10% The risk-free rate is... 12% overpriced The expected return on Stock B should be... 4% Stock B is currently... 6% [Choose ]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts