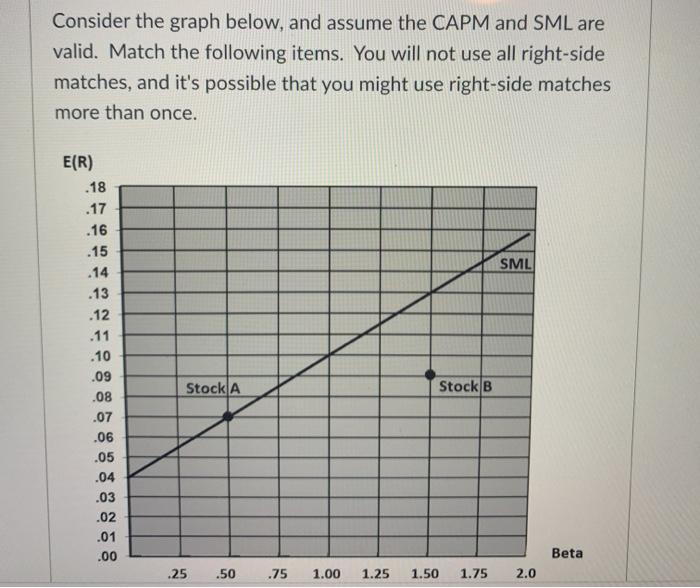

Question: Consider the graph below, and assume the CAPM and SML are valid. Match the following items. You will not use all right-side matches, and it's

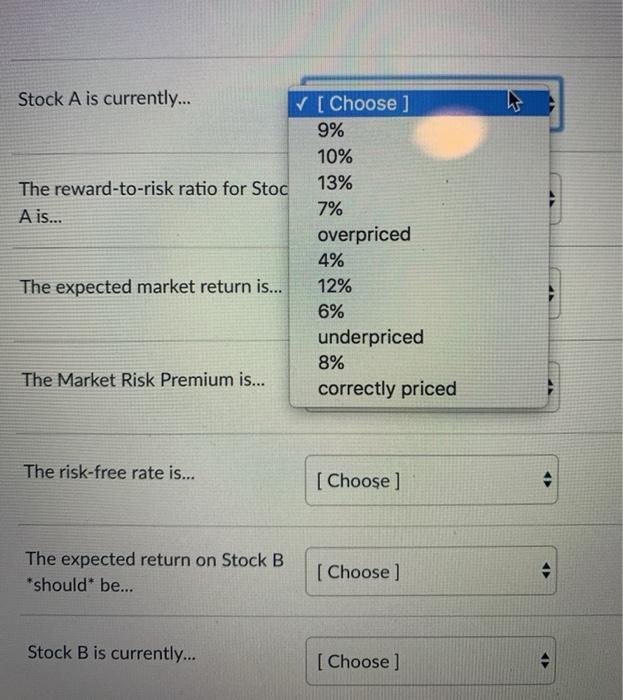

Consider the graph below, and assume the CAPM and SML are valid. Match the following items. You will not use all right-side matches, and it's possible that you might use right-side matches more than once. SML E(R) .18 .17 .16 .15 .14 .13 .12 .11 .10 .09 .08 .07 .06 .05 .04 .03 .02 .01 Stock A Stock B .00 Beta .25 .50 .75 1.00 1.25 1.50 1.75 2.0 Stock A is currently... [Choose ] 9% 10% The reward-to-risk ratio for Stoc 13% A is... 7% overpriced 4% The expected market return is... 12% 6% underpriced 8% The Market Risk Premium is... correctly priced The risk-free rate is... [Choose ] - The expected return on Stock B *should be... [Choose ] Stock B is currently... [Choose ] Stock A is currently... [Choose ] The reward-to-risk ratio for Stoc [Choose ] A is... 9% 10% 13% The expected market return is... 7% overpriced 4% The Market Risk Premium is... 12% 6% underpriced 8% The risk-free rate is... correctly priced The expected return on Stock B *should be... [Choose ] Stock B is currently... 4 [Choose ]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts