Question

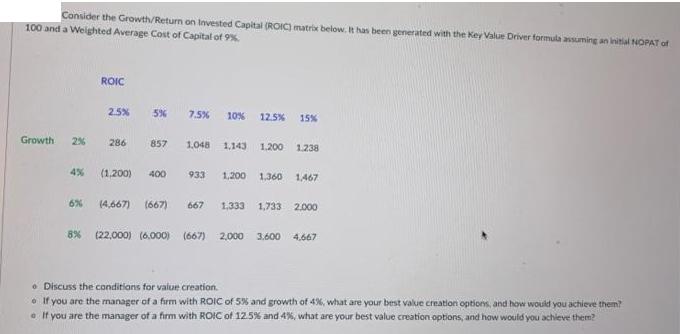

Consider the Growth/Return on Invested Capital (ROIC) matrix below. It has been generated with the Key Value Driver formula assuming an initial NOPAT of

Consider the Growth/Return on Invested Capital (ROIC) matrix below. It has been generated with the Key Value Driver formula assuming an initial NOPAT of 100 and a Weighted Average Cost of Capital of 9%. Growth 2% 6% ROIC 2.5% 5% 286 857 (1,200) 400 7.5% 10% 12.5% 1,048 15% 1.143 1.200 1.238 933 1,200 1,360 1467 (4,667) (667) 667 1,333 1,733 2000 8% (22,000) (6.000) (667) 2,000 3,600 4,667 Discuss the conditions for value creation. If you are the manager of a firm with ROIC of 5% and growth of 4%, what are your best value creation options, and how would you achieve them? If you are the manager of a firm with ROIC of 12.5% and 4%, what are your best value creation options, and how would you achieve them?

Step by Step Solution

3.44 Rating (135 Votes )

There are 3 Steps involved in it

Step: 1

Answer For value creation ROIC WACC For a firm having ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started