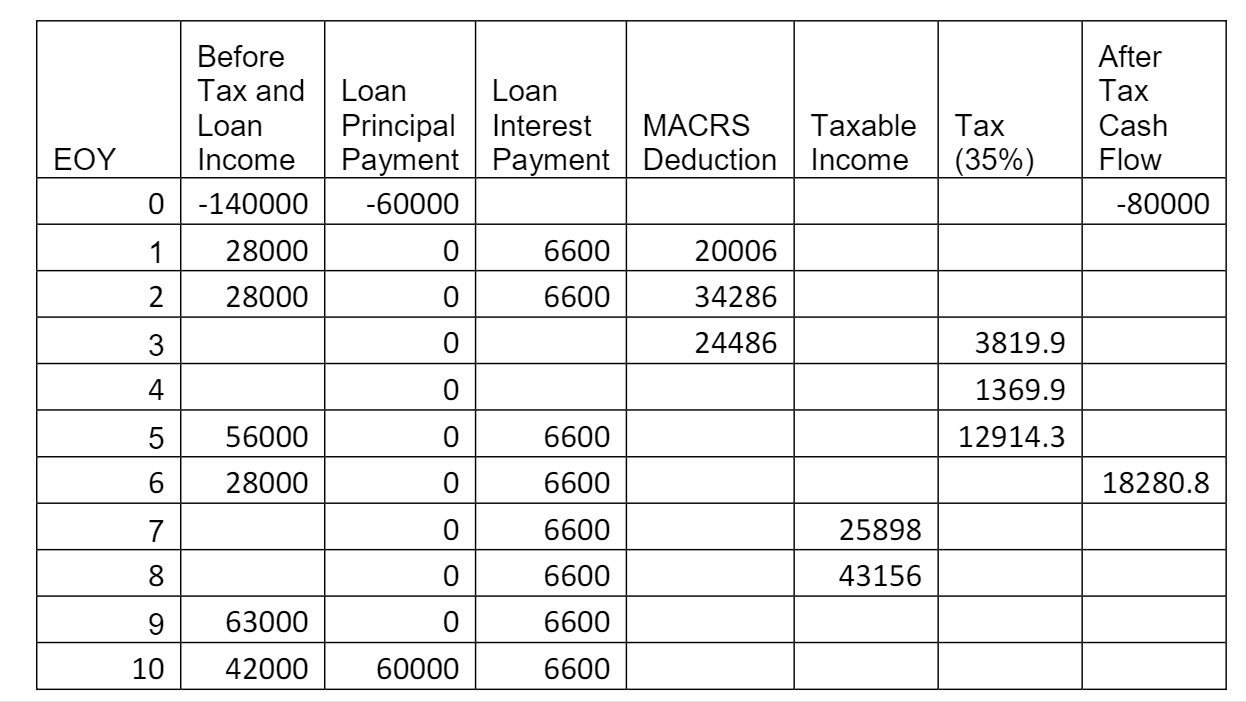

Question: Consider the incomplete cash flow shown in the table below. The cash flow includes the purchase of depreciable equipment. There is also a loan that

Consider the incomplete cash flow shown in the table below. The cash flow includes the purchase of depreciable equipment. There is also a loan that is paid off with periodic interest-only payments and a single payment of principal at EOY 10. Assume a tax rate of 35%. The table includes enough information to fill in the empty cells. a) What is the MACRS property class for the equipment and what was the purchase price? Hint: compare the ratios of the first few deductions to the corresponding ratios for each of the various property classes. b) Determine the After Tax Cash Flow for EOY 1. c) Determine the After Tax Cash Flow for EOY 4. d) Determine the After Tax Cash Flow for EOY 7.

Before Tax and Loan Loan Loan Principal Interest MACRS Income Payment Payment Deduction 0-140000 -60000 Taxable Income Tax (35%) After Tax Cash Flow -80000 EOY 1 0 6600 20006 28000 28000 2 0 6600 34286 24486 3 0 3819.9 4 0 1369.9 56000 0 6600 12914.3 5 6 28000 0 6600 18280.8 0 25898 7 8 6600 6600 0 43156 9 63000 0 6600 9 10 42000 60000 6600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts