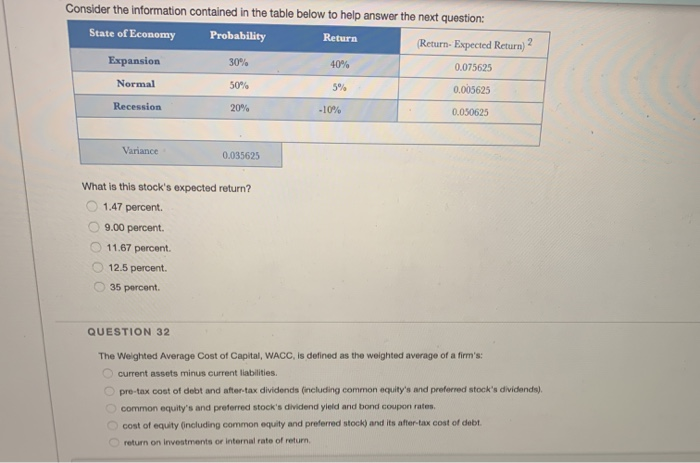

Question: Consider the information contained in the table below to help answer the next question: State of Economy Probability Return (Return. Expected Return) 2 Expansion 30%

Consider the information contained in the table below to help answer the next question: State of Economy Probability Return (Return. Expected Return) 2 Expansion 30% 40% 0.075625 Normal 50% 5% 0.005625 Recession 20% 10% 0.05062 Variance 0.035625 What is this stock's expected return? 1.47 percent 9.00 percent. 11.67 percent. 12.5 percent 35 percent QUESTION 32 The Weighted Average Cost of Capital, WACC, is defined as the weighted average of a firm's current assets minus current liabilities. pre-tax cost of debt and after-tax dividends (including common equity's and preferred stock's dividends). common equity's and preferred stock's dividend yield and bond coupon rates, cost of equity including common equity and preferred stock) and its after tax cost of debt. return on investments or internal rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts