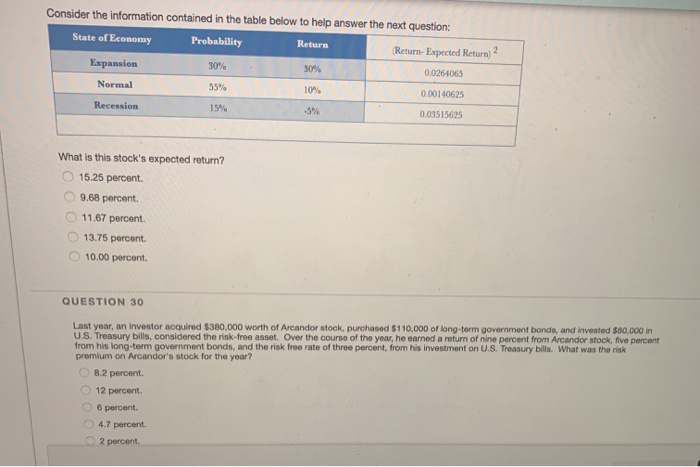

Question: Consider the information contained in the table below to help answer the next question: State of Economy Probability Return Return-Expected Return)? Expansion 30% 30% 0.0264065

Consider the information contained in the table below to help answer the next question: State of Economy Probability Return Return-Expected Return)? Expansion 30% 30% 0.0264065 Normal 39% 10% 0.00140625 Recession 15% 5% 0.08515625 What is this stock's expected return? 15.25 percent 9.68 percent 11.67 percent. 13.75 percent 10.00 percent. QUESTION 30 Last year, an investor acquired $380,000 worth of Arcandor stock, purchased $110,000 of long-term government bonds, and invested $80,000 in U.S. Treasury bills, considered the risk-free asset. Over the course of the ye, he earned a return of nine percent from Arcandor stock, five percent from his long-term government bonds, and the risk free rate of three percent, from his investment on U.S. Treasury bills. What was the risk premium on Arcandor's stock for the year? 8.2 percent. 12 percent 6 percent. 4.7 percent. 2 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts