Question: Consider the intertemporal choice between current and future consumption. The typical perfectly foresighted household lives for two periods and i t has n o inherited

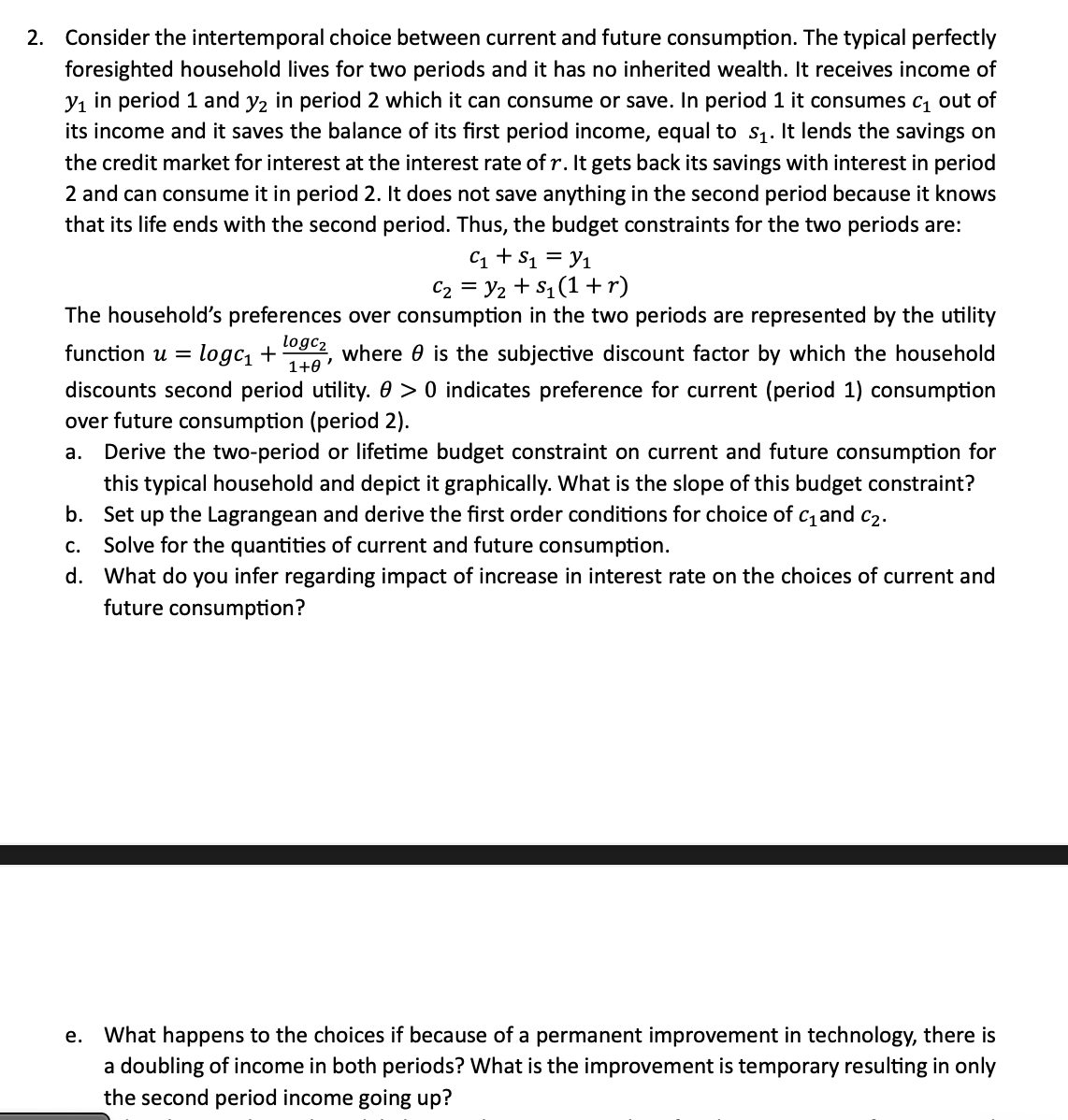

Consider the intertemporal choice between current and future consumption. The typical perfectly

foresighted household lives for two periods and has inherited wealth. receives income

period and period which can consume save. period consumes out

its income and saves the balance its first period income, equal lends the savings

the credit market for interest the interest rate gets back its savings with interest period

and can consume period does not save anything the second period because knows

that its life ends with the second period. Thus, the budget constraints for the two periods are:

The household's preferences over consumption the two periods are represented the utility

function where the subjective discount factor which the household

discounts second period utility. indicates preference for current consumption

over future consumption

Derive the twoperiod lifetime budget constraint current and future consumption for

this typical household and depict graphically. What the slope this budget constraint?

Set the Lagrangean and derive the first order conditions for choice and

Solve for the quantities current and future consumption.

What you infer regarding impact increase interest rate the choices current and

future consumption?

What happens the choices because a permanent improvement technology, there

a doubling income both periods? What the improvement temporary resulting only

the second period income going

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock