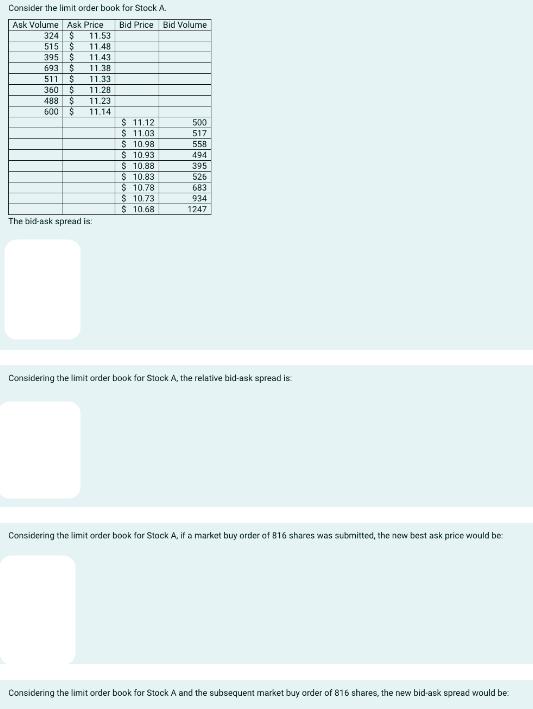

Question: Consider the limit order book for Stock A. Ask Volume Ask Price Bid Price Bid Volume 324 $ 11.53 515 $ 11.48 395 $

Consider the limit order book for Stock A. Ask Volume Ask Price Bid Price Bid Volume 324 $ 11.53 515 $ 11.48 395 $ 11.43 693 $ 11.38 511 $ 11.33 360 $ 11.28 488 $ 11.23 600 $ 11.14 The bid-ask spread is $11.12 $11.03 $10.98 $10.93 $10.88 $10.83 $10.78 $ 10.73 $ 10.68 500 517 558 494 395 525 683 934 1247 Considering the limit order book for Stock A, the relative bid-ask spread is Considering the limit order book for Stock A, if a market buy order of 816 shares was submitted, the new best ask price would be Considering the limit order book for Stock A and the subsequent market buy order of 816 shares, the new bid-ask spread would be

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Youve provided an image of a limit order book for Stock A along with some questions The limit order book shows various ask and bid prices along with t... View full answer

Get step-by-step solutions from verified subject matter experts